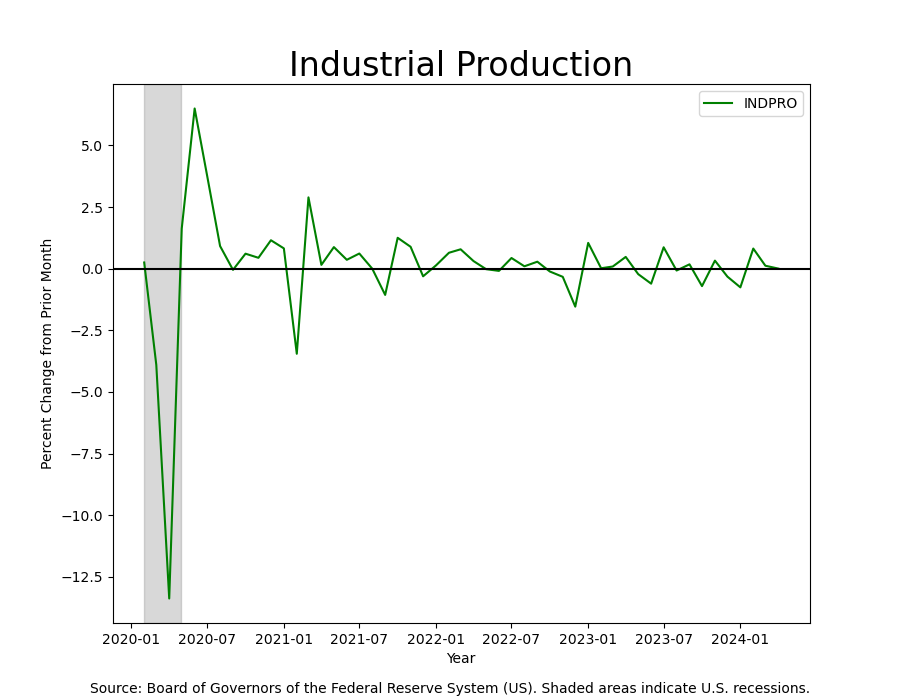

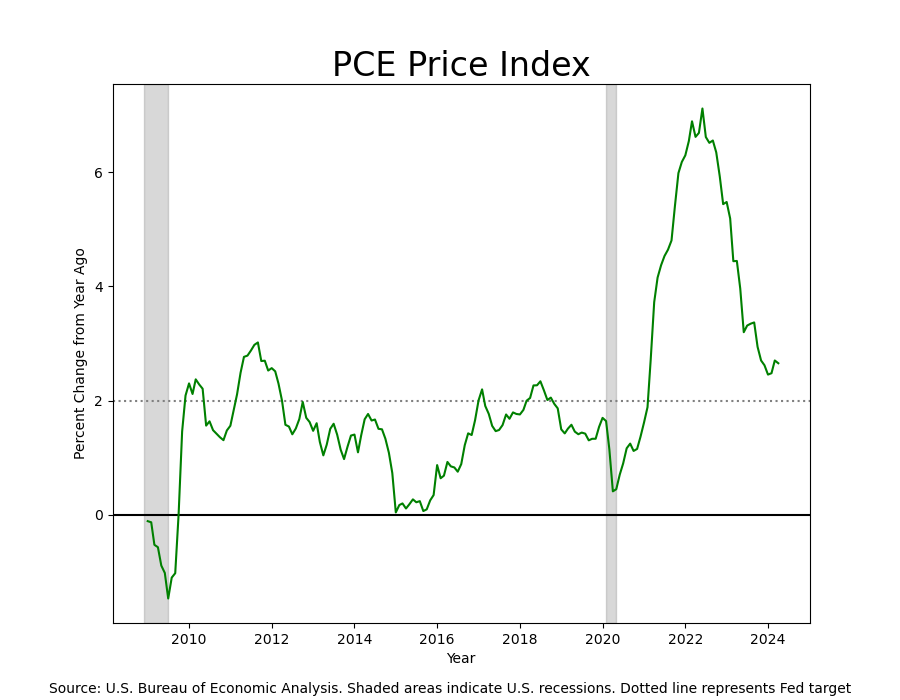

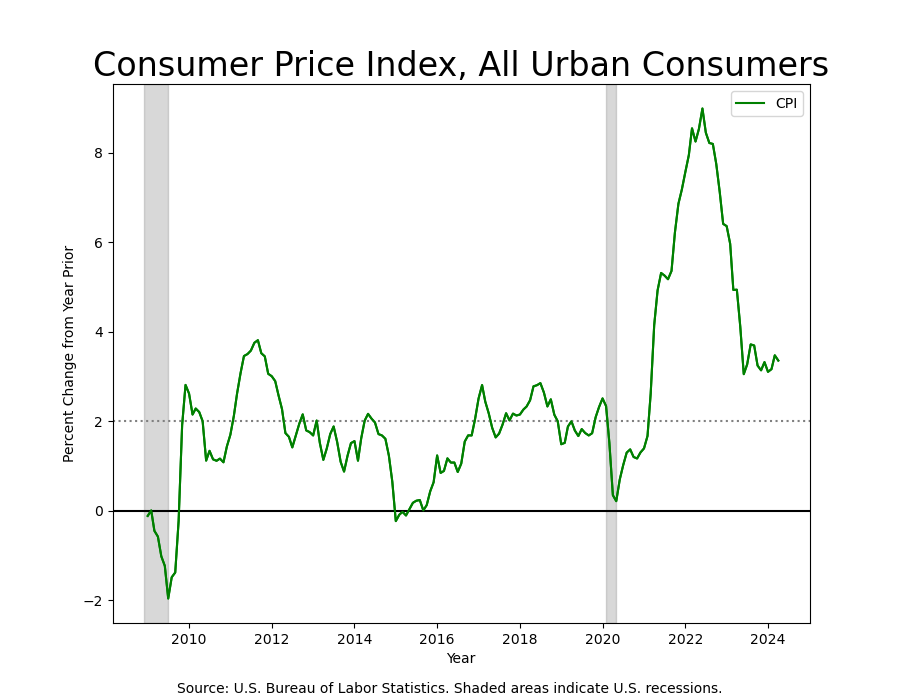

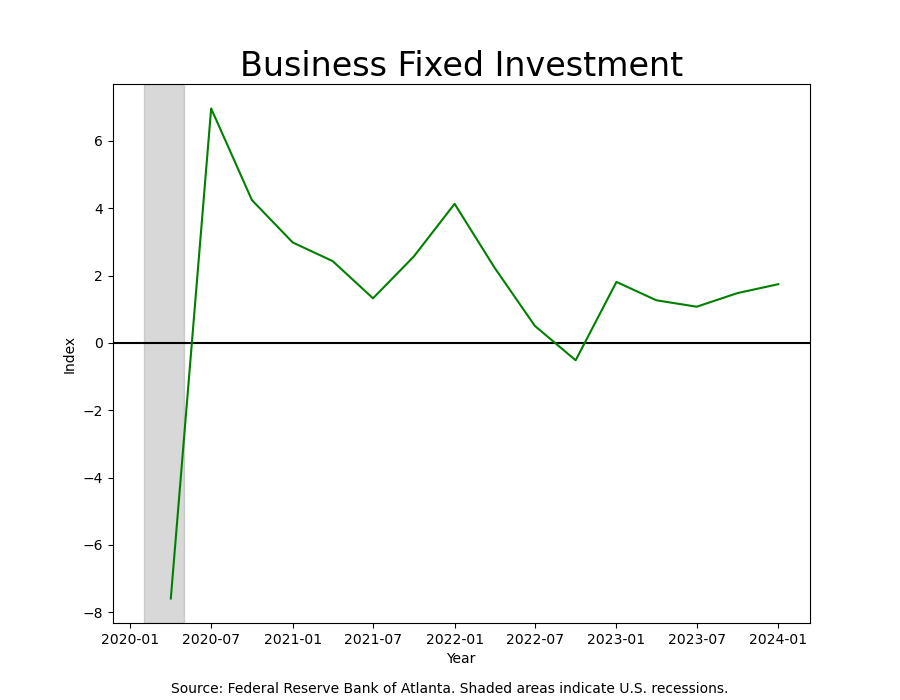

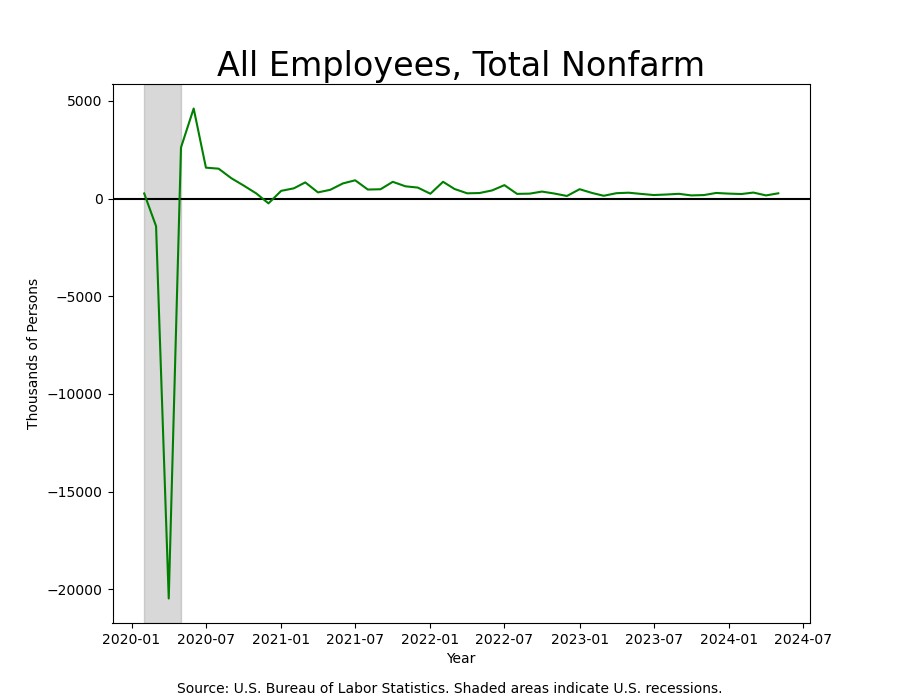

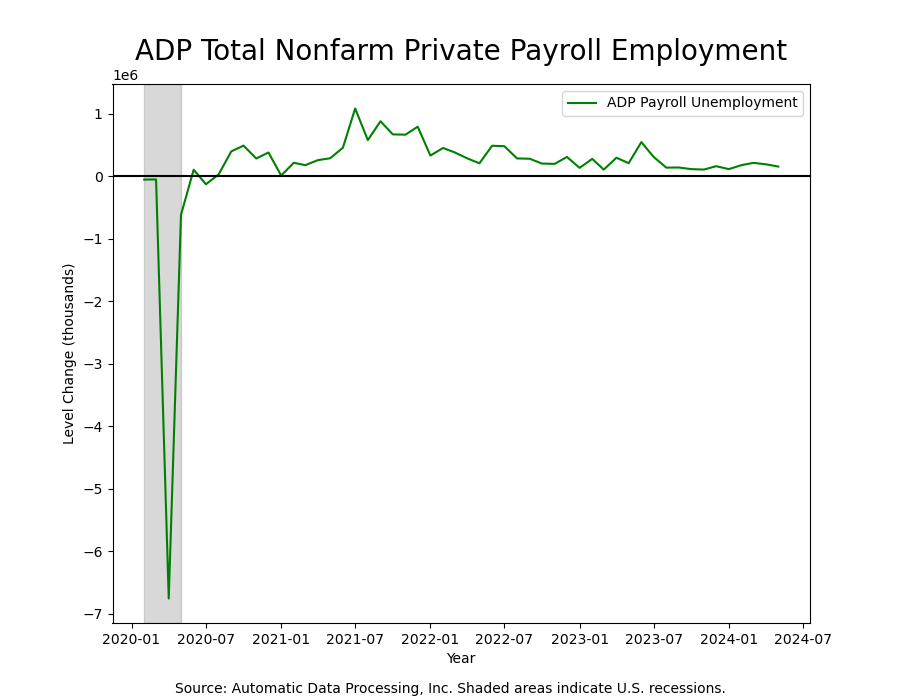

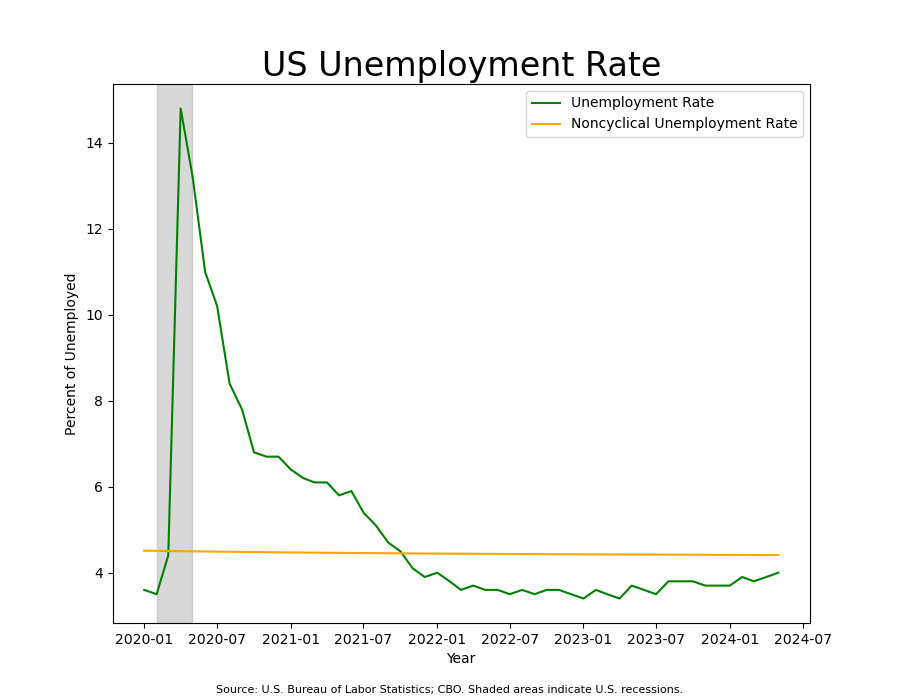

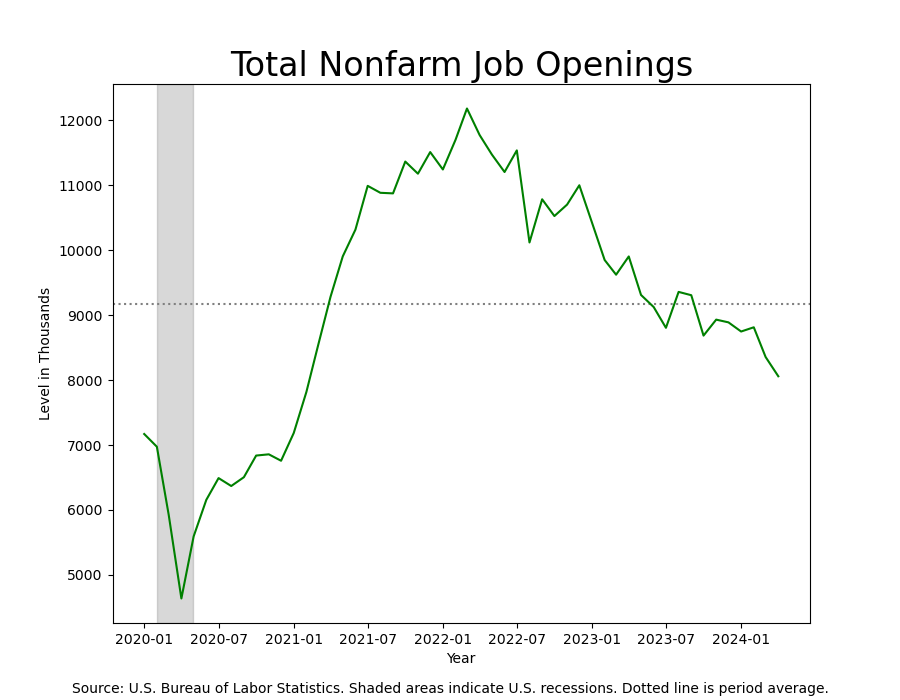

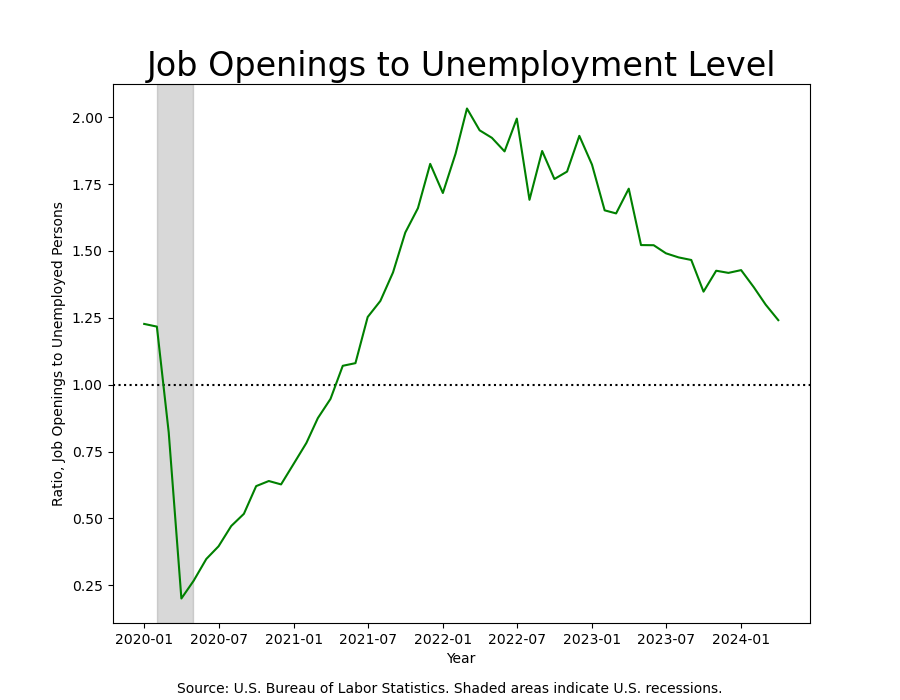

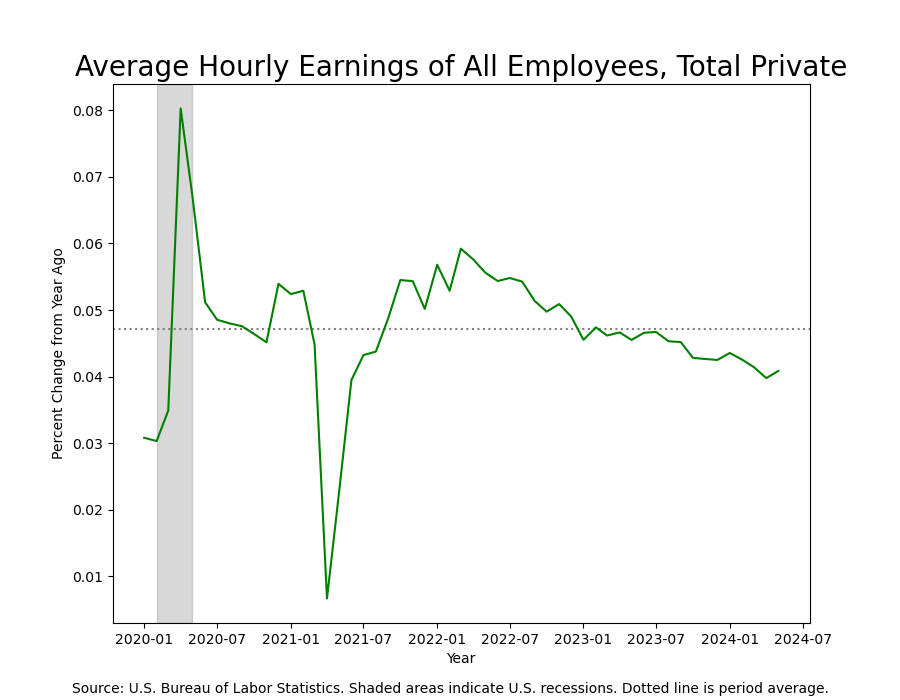

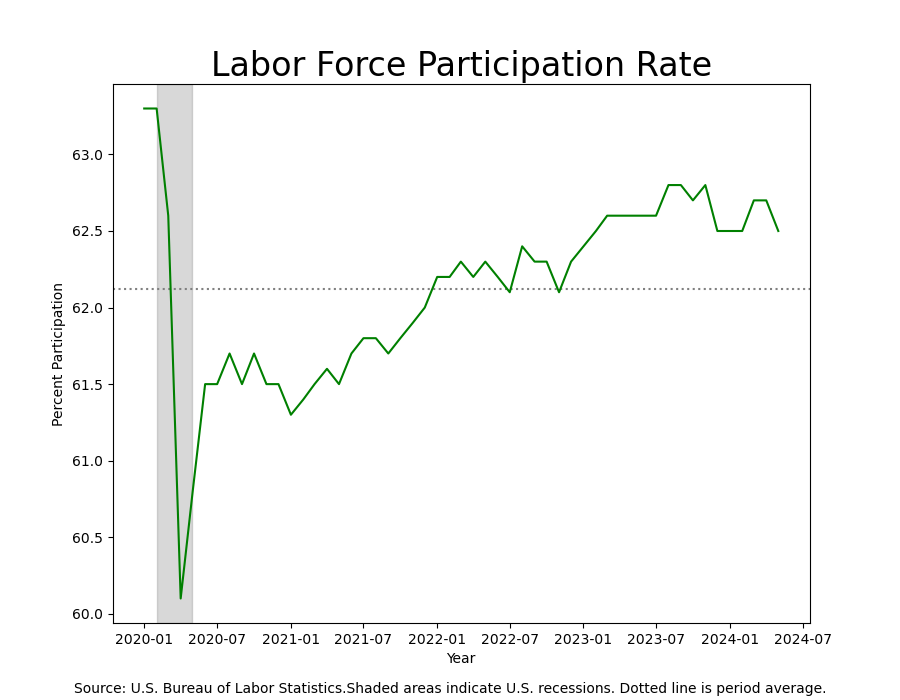

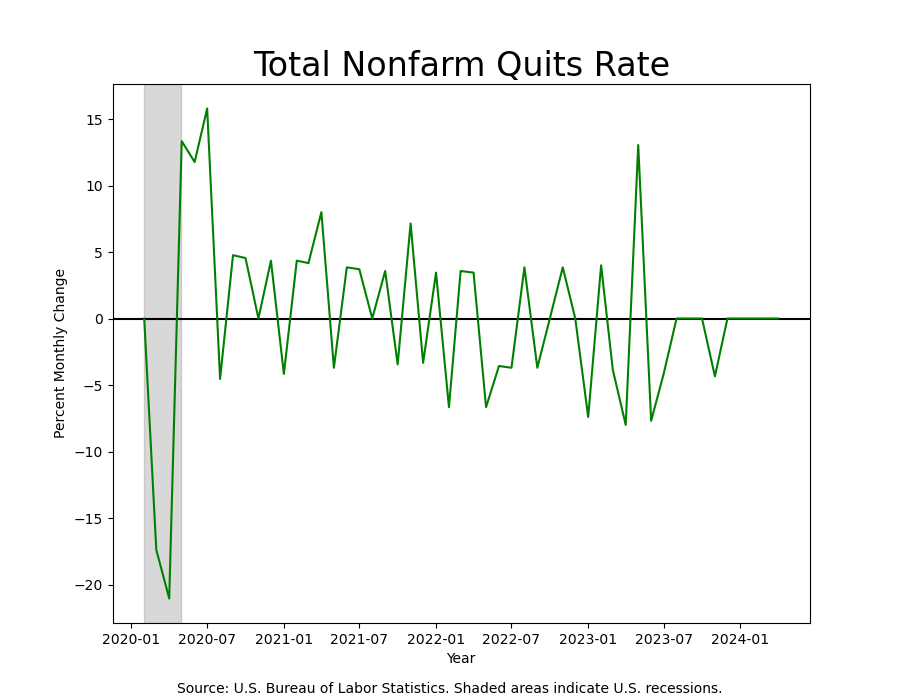

We’ve written before that interest rates are clearly in restrictive range; that the economy, while still expanding, is doing so at a slower pace; and inflation, though elevated, has resumed its downward wander. But inflation remains above target, the labor market is tight, yields are flat, and commodities are up. One is inclined to ask, “Where are we in the business cycle, exactly?”

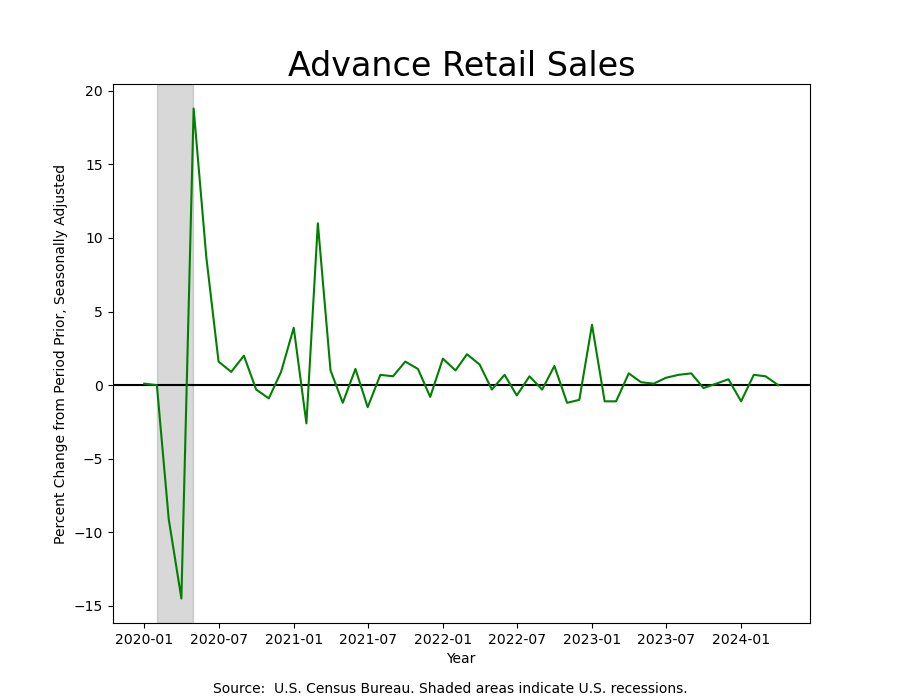

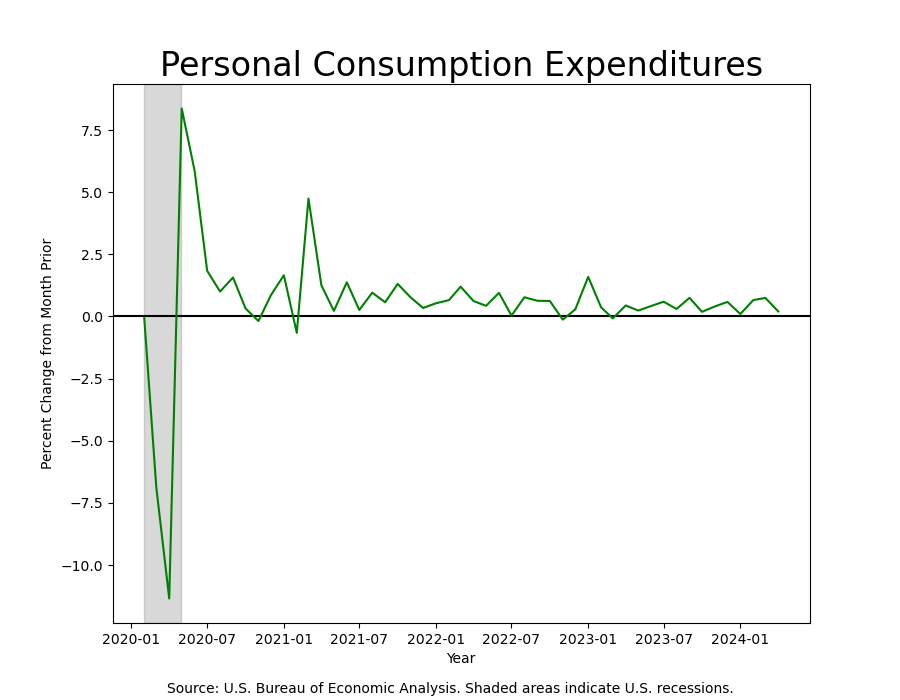

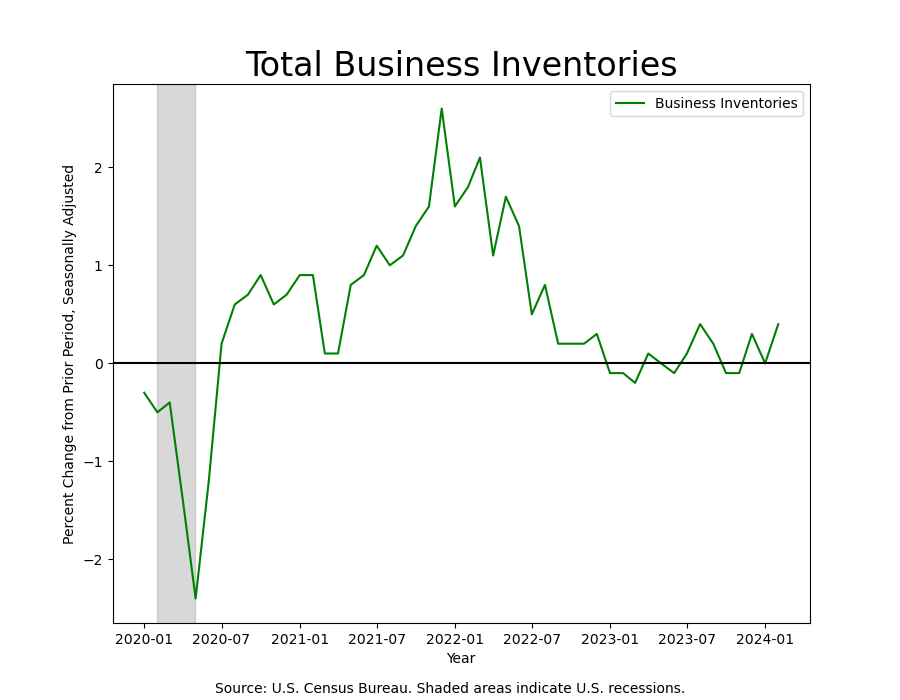

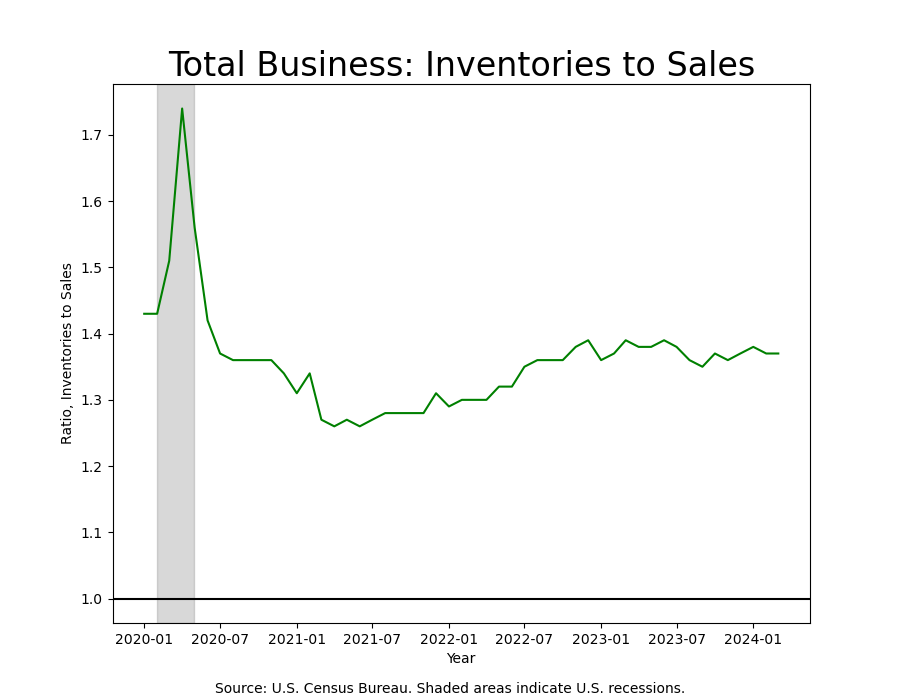

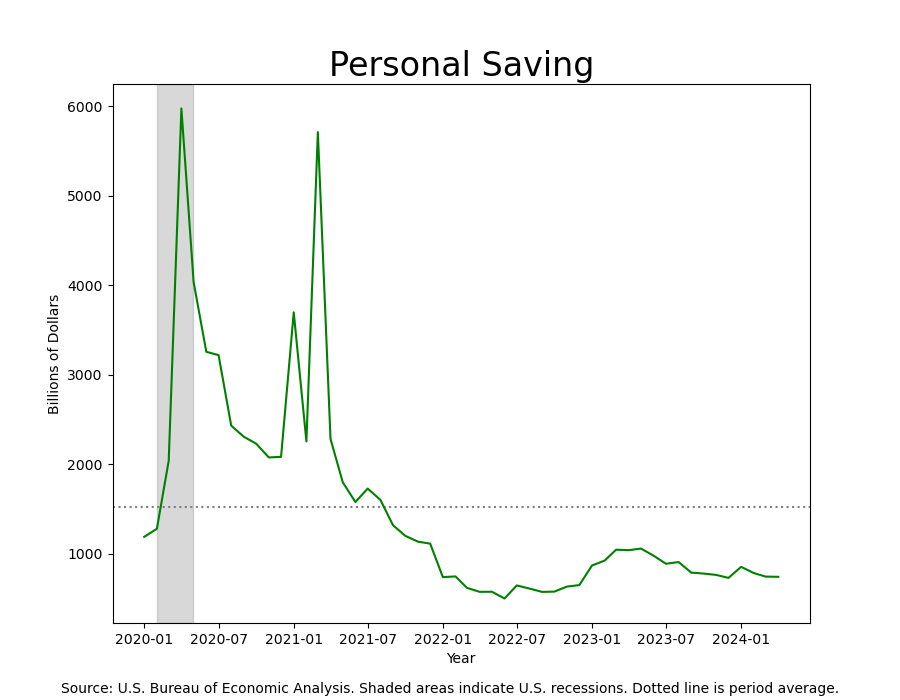

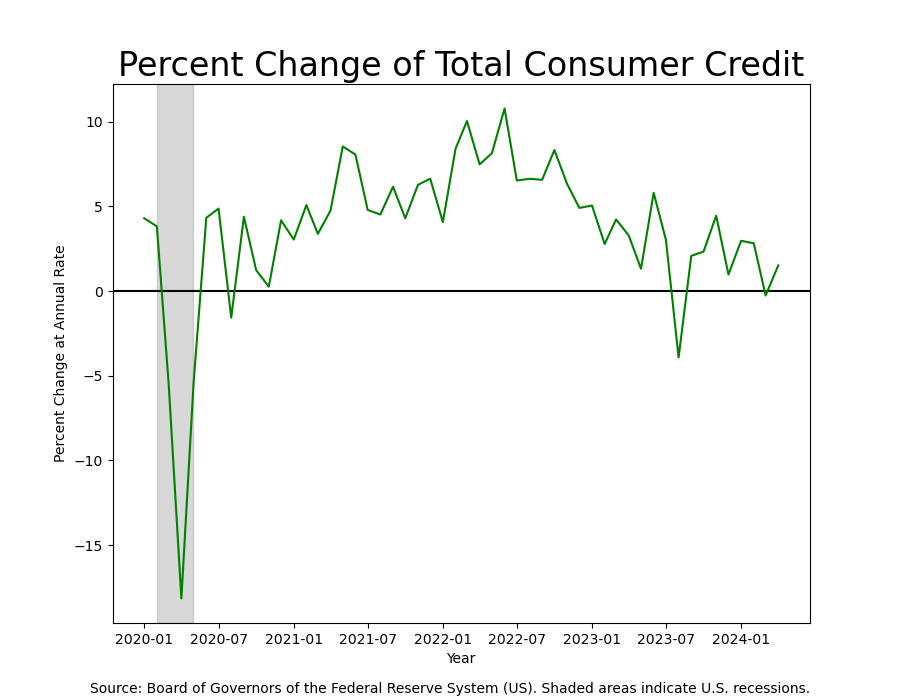

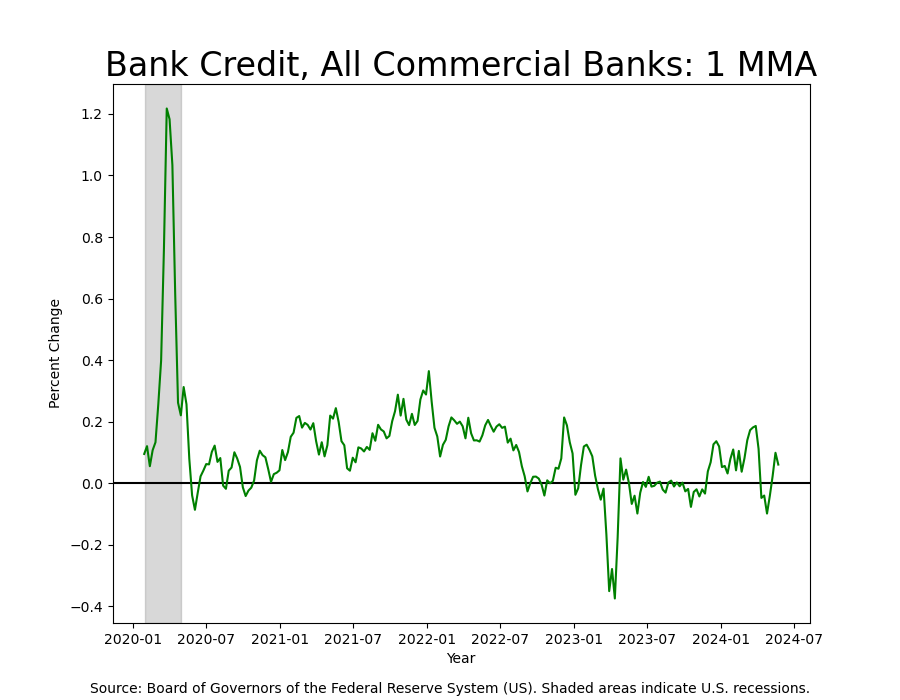

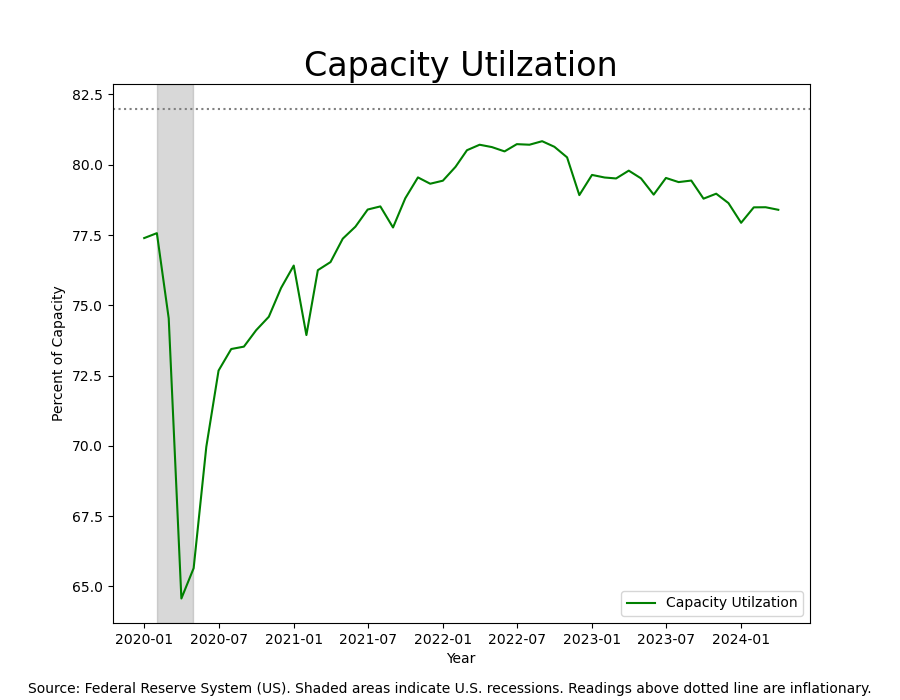

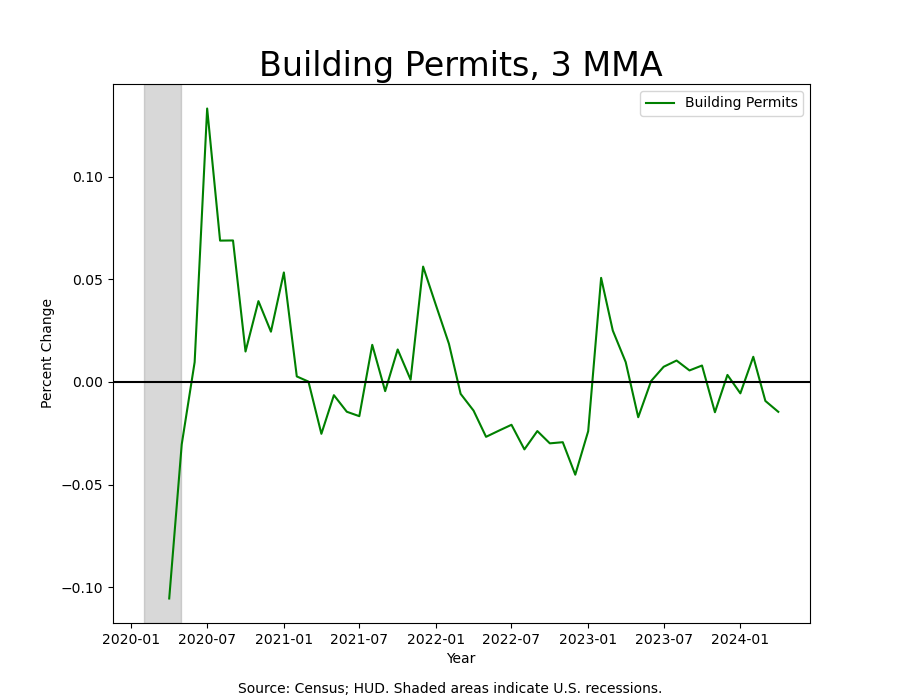

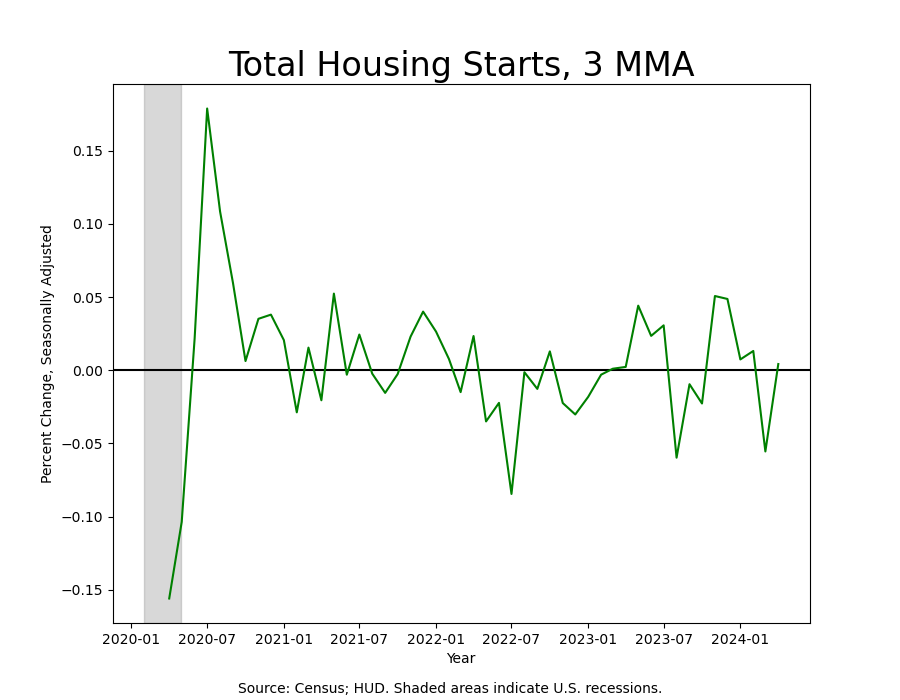

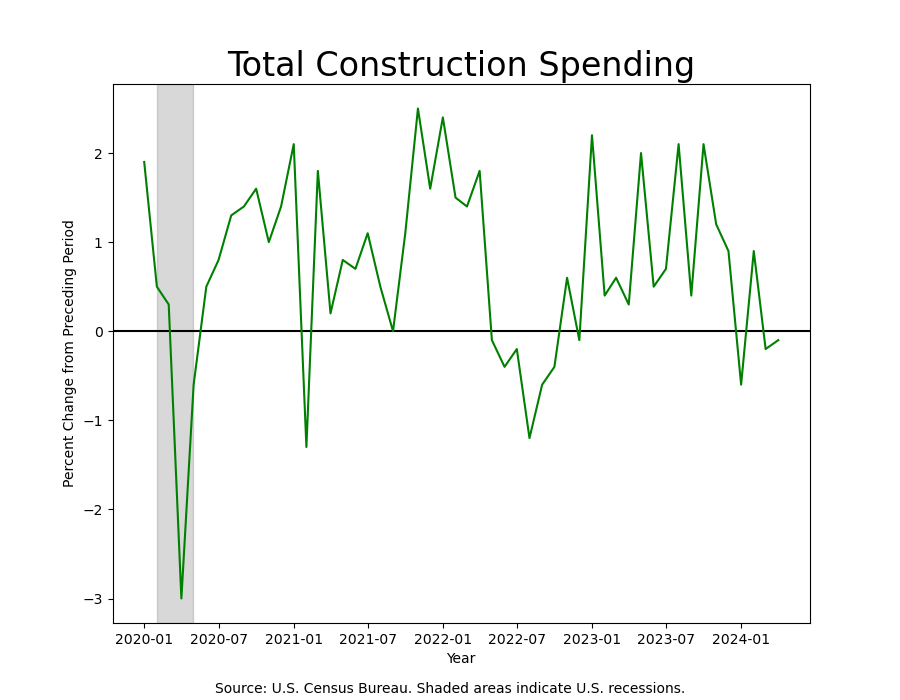

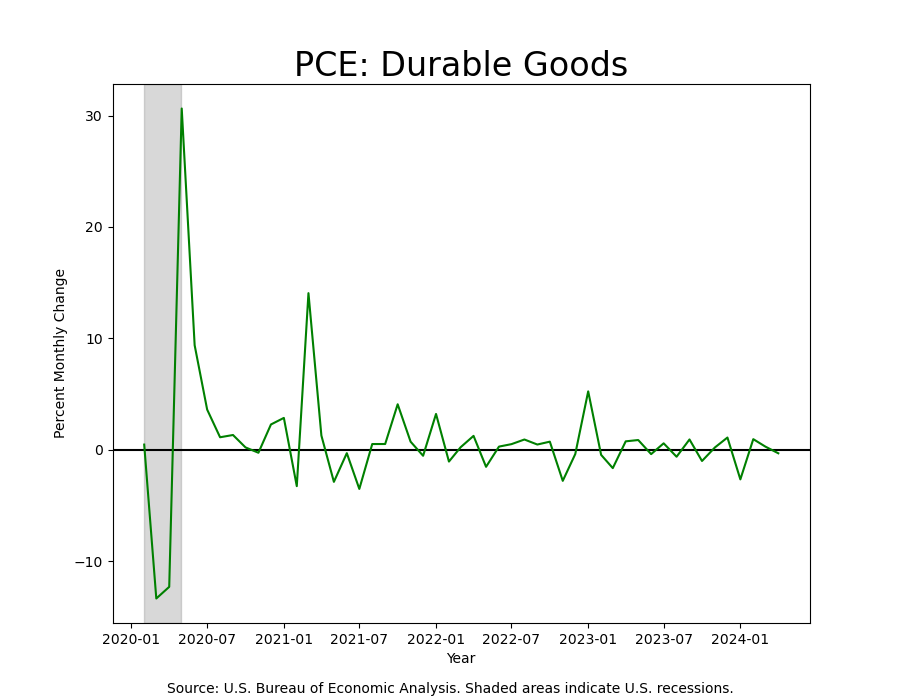

Unfortunately, we don’t get the benefit of precision when it comes to our instrumentation, but using a mosaic of data we can make a rough approximation of where we are in the cycle. These suggest that we are in the late stages of the business cycle, where the economy is downshifting from Expansion to Slowdown, but has not yet tipped into Contraction.

All this aside, declining inflation, plus diminished rate cut expectations, plus higher yields, plus no change in the policy rate spells a passive rate hike. While lower rates in the last quarter of 2023 sped the economy on its way, higher rates in the first and second quarter of 2024 apply the brake. Already restrictive rates should become more restrictive, and ironically create the contraction in growth that has so far lied just over the horizon.

Share this post