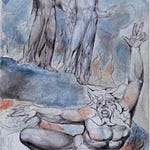

The way at first is arduous, and scarecely Do my horses, fresh in morning, ascend it; Mid-sky it’s highest—from where, looking down On sea and land even I am often Given to fear and trembling in my heart With the sheer terror of it. Last, The decline is steep and needs a steady hand. -Ovid, Metamorphoses II.63-67

As we wrote last week, economic growth is still positive but slowing. We argued that inflation has been largely vanquished except for shelter prices, and that the Federal Reserve’s interest rate policy was too restrictive and risked injuring the labor market. And while we called for at least a quarter of a point interest rate cut at its meeting on Wednesday, we expected our calls to go unheeded; and despite our remonstrance falling on deaf ears, we nonetheless opined that the Fed would set the stage for rate cuts starting as early as September. We also forecast a de facto interest rate cut resulting from the Chair’s comments, which we now see priced in. Our parting question was whether waiting until September was prudent given the risk that delaying interest rate cuts might exacerbate incipient weakness in the labor market.

As we continually state, one month’s data aren’t enough to tip the balance in one direction or another; data are noisy, imprecise, and given to measurement error, so it is the trend that we must look to for illumination of our current query. As at the beginning of every month, we look to Non-farm Payrolls for our first read on the health of the labor market, and of the broader economy. There a concerning trend has developed. The US economy generated 114,000 new jobs in July, a second month of declines. June’s number of new jobs was revised downward as well.

Thanks for reading Fieldnotes! Subscribe for free to receive new posts and support my work.

Subscribe

The pace of job generation is slackening.

The BLS report confirms the private report provided by Payroll provider ADP earlier in the week.

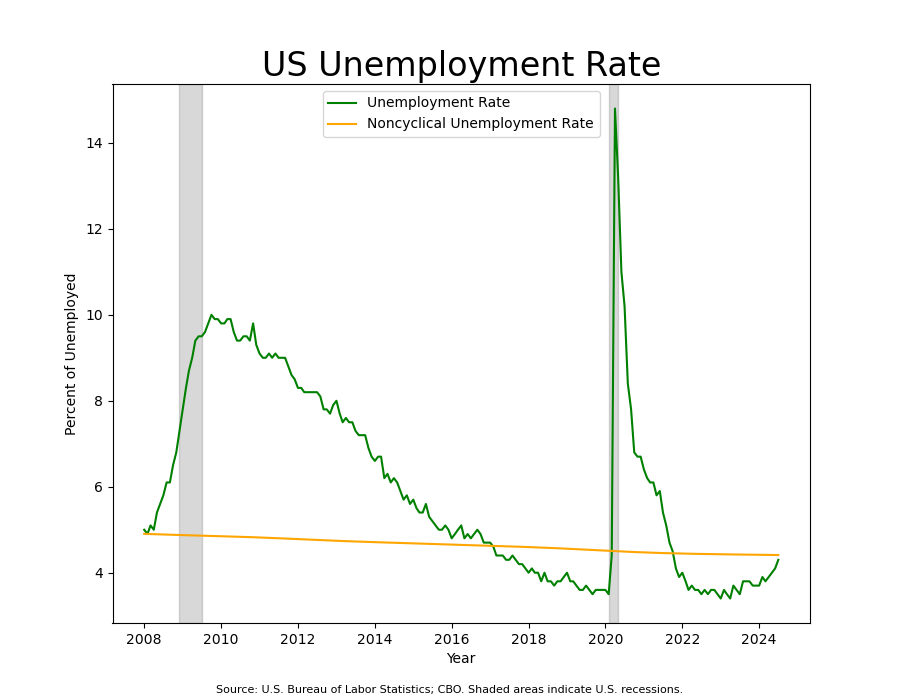

The average for the last three months of 170,000 new jobs per month is down 22% from the prior three-month average of 218,000. The unemployment rate also increased to 4.3% and sits just below the structural rate of unemployment, that rate of unemployment which is thought to always exist in an economy due to non-cyclical factors.

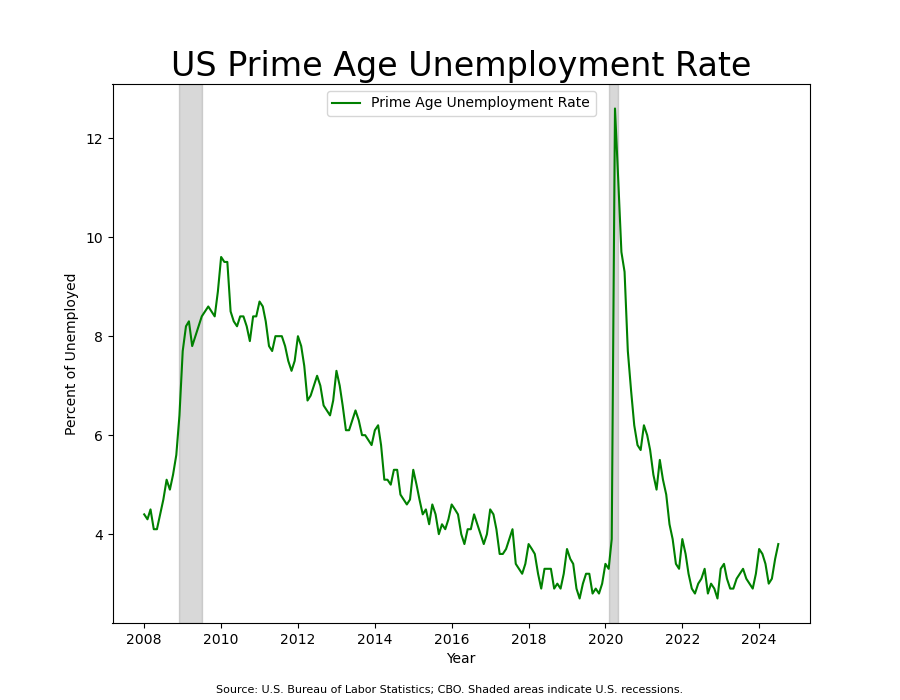

Unemployment among workers in their working age prime is up to a somewhat concerning 3.8%. Of all the workers in the workforce that we should expect to have jobs, this is the cohort (25 -54 years old) that should.

Job Openings fell again, although not by much.

This brings the number of Job Openings-to-Unemployed, a ratio that informs us of the balance between demand and supply in the labor market, back to its pre-COVID 19 Pandemic level.

A consequence of the improving balance of supply of workers and demand for labor in the labor market is that the price at which the market clears—the wage rate—falls. We see this in lower-frequency data, such as the Employment Cost Index

as well as in the higher-frequency Average Hourly Earnings report.

With the diminishing rate of wage increases comes a lower inflation rate. These sticky, persistent sources of inflation continue to trend in the right direction to presage a return to acceptable levels of inflation (i.e., 2%).

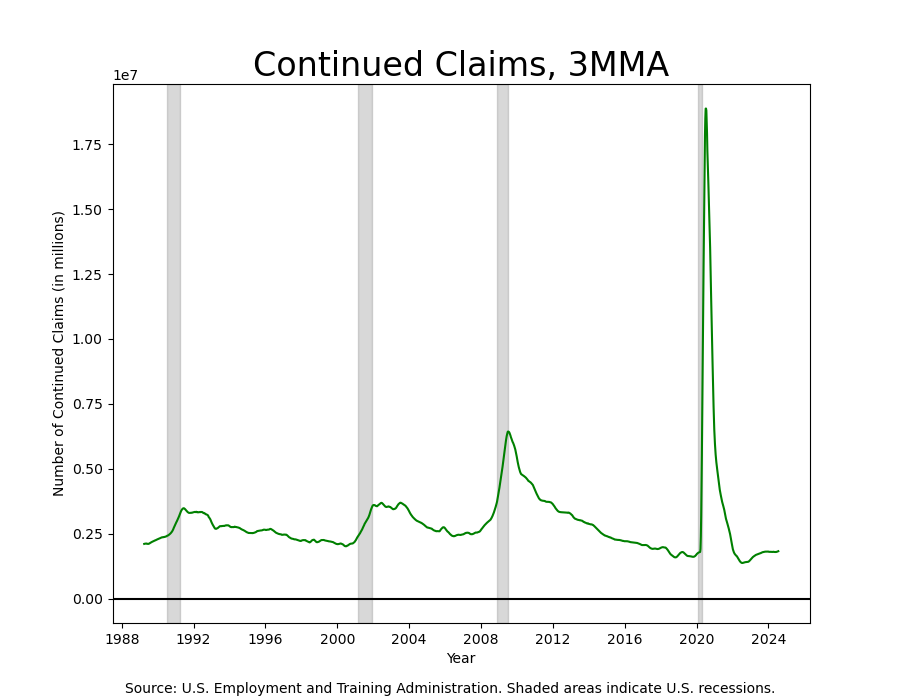

Initial Claims for Unemployment Insurance have increased to the highest level in a year,

while Continued Claims are similarly higher than in the past year.

The Quit Rate is now below its pre-COVID level, suggesting that workers are not confident about leaving their job to find a new one.

In a sign that the labor market, while no longer supercharged, is still fundamentally healthy Involuntary Separations are still below their pre-COVID average and trending lower. Employers have not begun to shed workers in this manner, at least according to this data.

Another encouraging sign is that the Participation Rate increased slightly. Discouraged workers don’t enter the labor force, they leave it.

So, the bottom isn’t falling out of the labor market, but it is clearly weakened and weakening. With the rise of unemployment to 4.3%, we also saw the triggering of the Sahm rule, an empirical regularity that has an impressive track record of signaling when the US economy is in or entering economic recession.

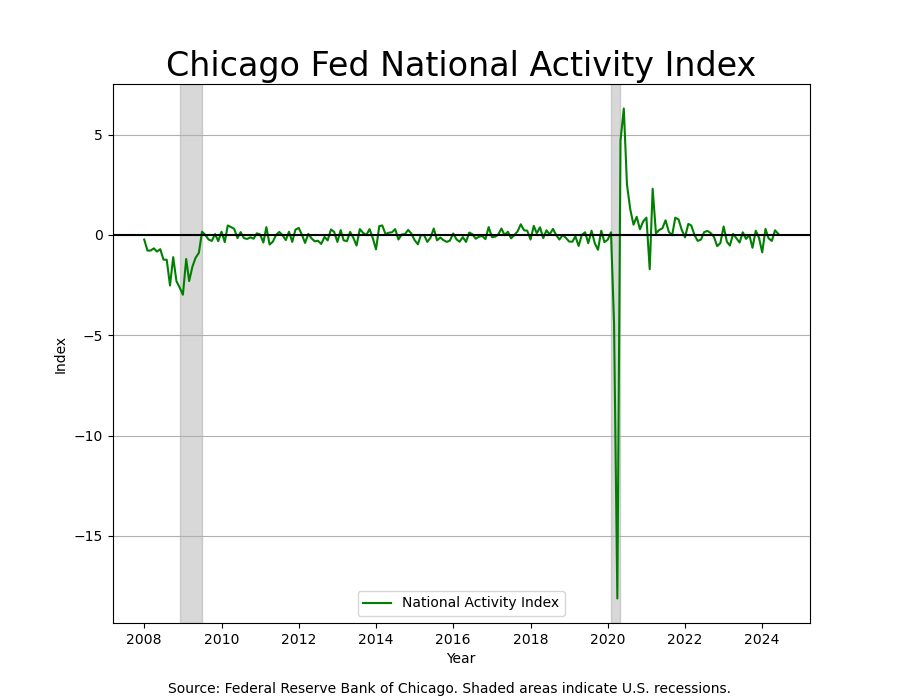

Given the overall health of the labor market as measured by the low rate of unemployment, the economy is likely not in nor imminently entering recession. So, the Sahm rule is not likely to be correct in signaling current recession; however, it is pointing in the direction of continued labor market weaking that, if left unaddressed, will likely result in recession. This is consistent with the declining level of economic activity, as evidenced in the Federal Reserve Bank of Chicago’s National Activity Index, which has been signaling recent weakness.

Surprises have been to the downside.

The Bank’s Financial Conditions Index paints a similar picture. It is financial conditions that are driving the weakness.

The Federal Reserve likely now regrets its decision, as Helios did in allowing Phaethon to take the chariot of the sun out for a spin. In Ovid’s narrative, the mortal Phaethon doesn’t have the right stuff, drops the reins and the chariot of the sun swerves too far from earth in one place, leaving an arctic waste in its path, and too close in another, trailing a path of smoldering ruin. Finally, to preserve the earth, Zeus strikes down Phaethon, ending the climatic joyride. It’s not too late to knock the charioteer from the sky with a well-aimed thunderbolt and prevent the freezing of the labor market.

Share this post