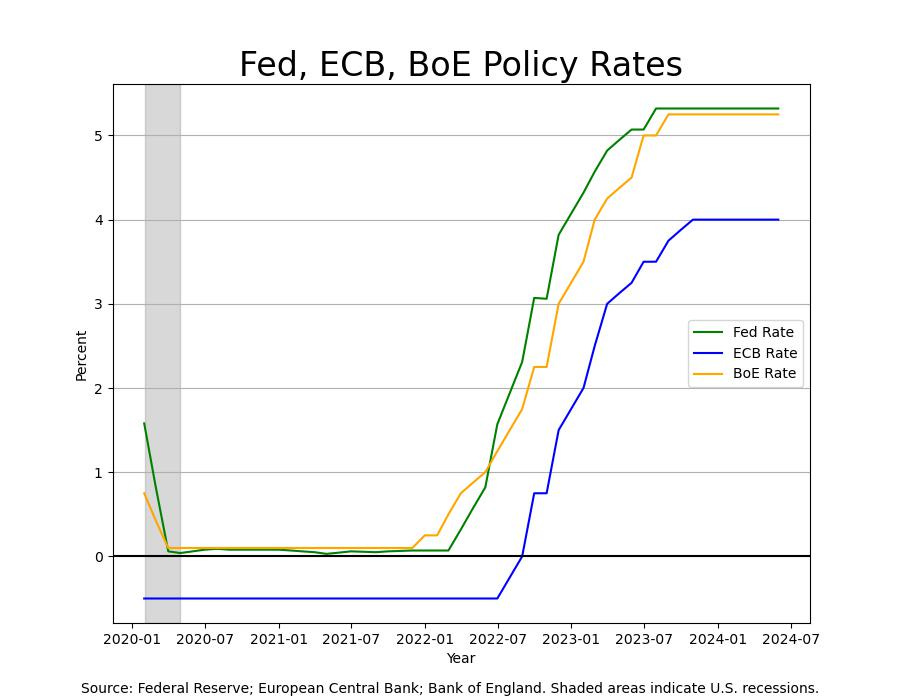

The lead economist for the European Central Bank (ECB), Philip Lane, let us know in an interview with the Financial Times that the Eurozone group of economies has made enough progress against inflation to warrant cutting interest rates, barring any major surprises, at its next meeting June 6. The short-term interest rate currently stands at 4% for the 20 member states that use the Euro, where it has been since September of 2023.

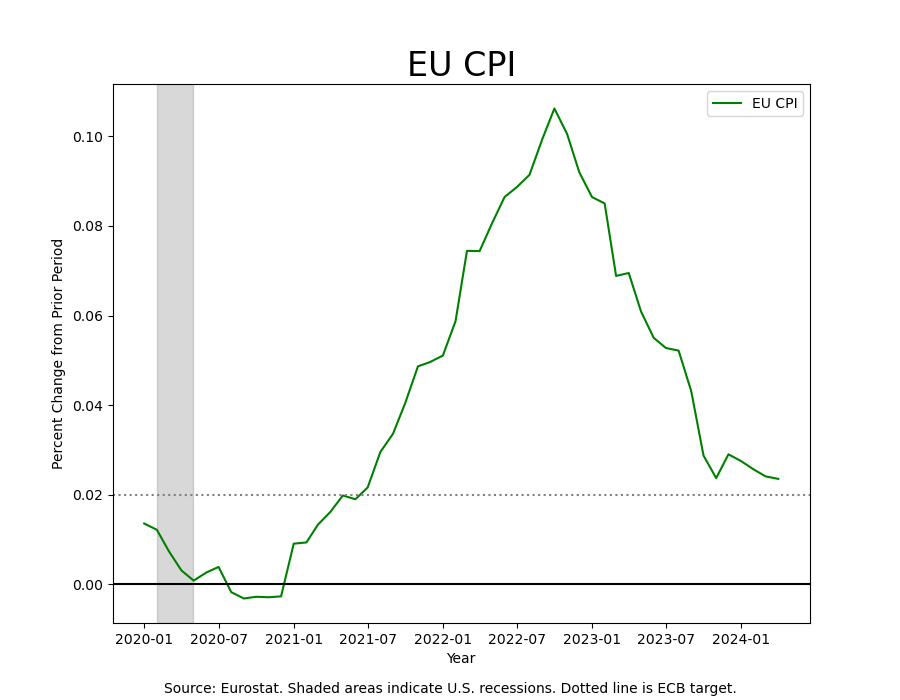

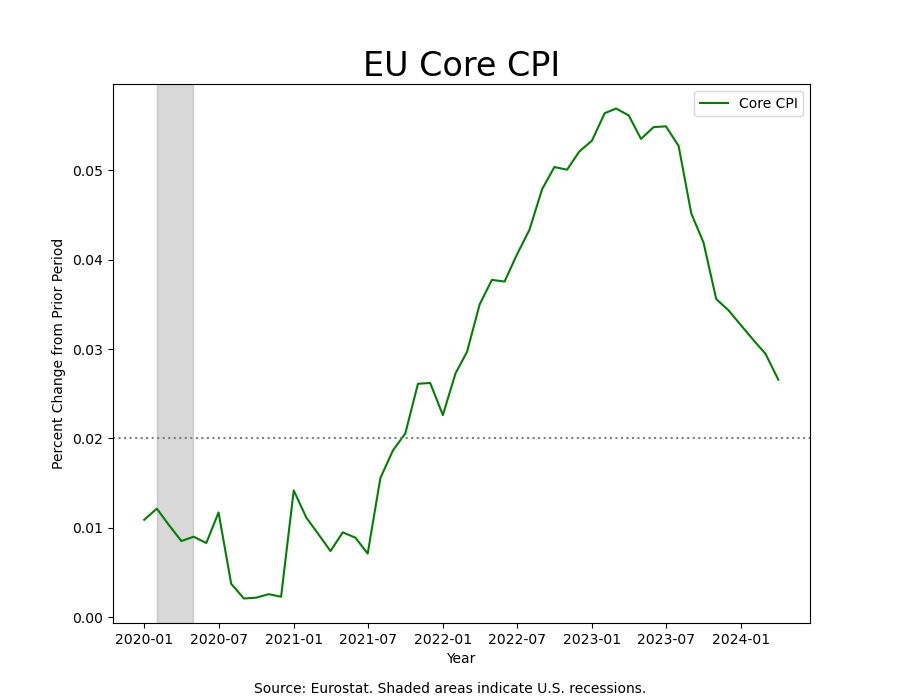

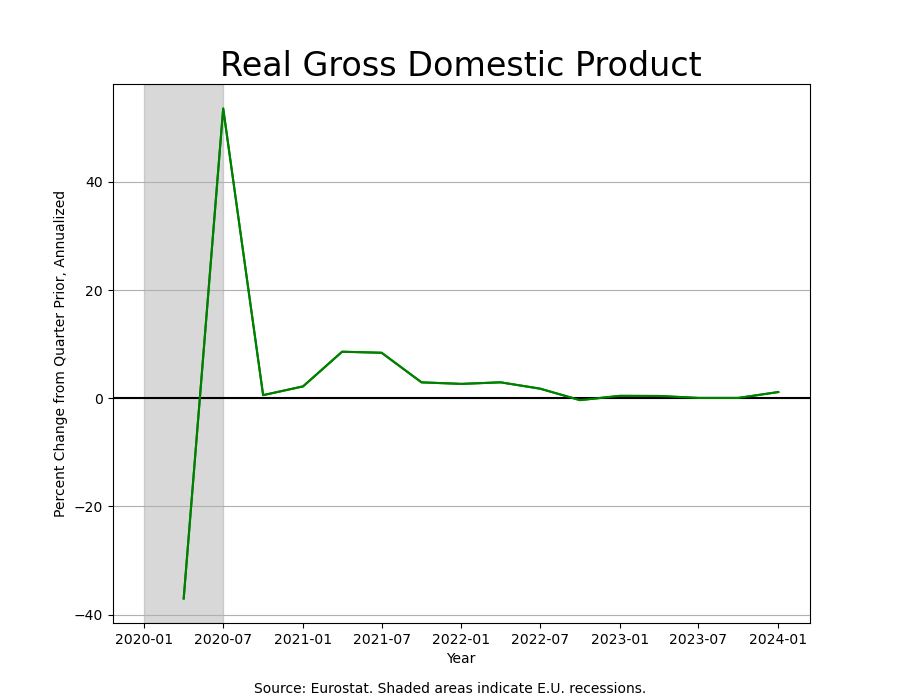

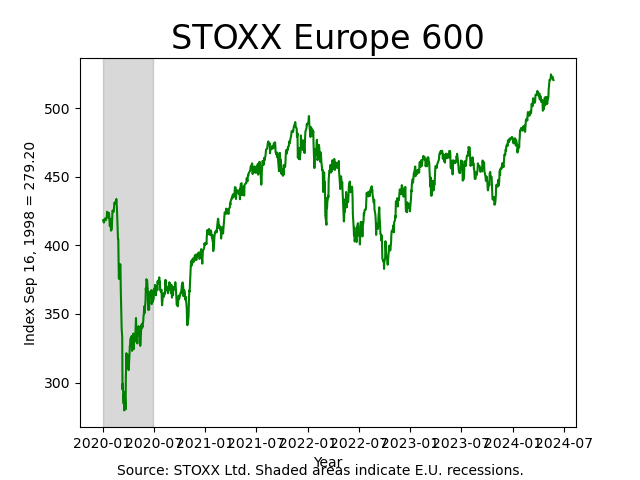

The Eurozone appears to be transitioning from the Contraction phase of the business cycle to Recovery, in which short rates fall, equities rally, inflation falls or is quiescent, and bond yields are flat. The United States, however, still looks to be in transition from Expansion to Slowdown, so the Eurozone and the ECB find themselves in the unusual position of being the first major economy to relax interest rates. The United States may not be far behind, but for the meantime, Europe for the first time must become accustomed to leading the way.

Photo credit: Roman Eisele

Share this post