In Which: We Consider a Faustian Bargain

The last fortnight was a pretty interesting one in the good ole US of A. We got some new inflation numbers, had a Federal Open Market Committee (FOMC) meeting, Fed Chair Jerome Powell rattled a saber, jobless claims reached a six-month high and unreliable sentiment surveys fell.

All in all, the economy remains in pretty good shape. Inflation, the Labor Market and Aggregate Demand continue to come in, albeit hesitantly. The Housing Market continues to be a drag on the economy, and will be until housing prices fall, the bond yield falls, income rises, or cultural mores change as people seek more square footage in public or privately shared spaces. Most likely it will be some combination of the four. Real rates are at restrictive levels, and their impact can be observed in the decline in the Housing Market and Durable Goods demand, but overall better balance sheets and growing incomes have blunted interest rate policy’s ability to restrain the overall economy. Rates markets have repriced the timing of interest rate cuts this year and next, which have raised effective interest rates, producing tighter financial conditions that cause the economy to slow.

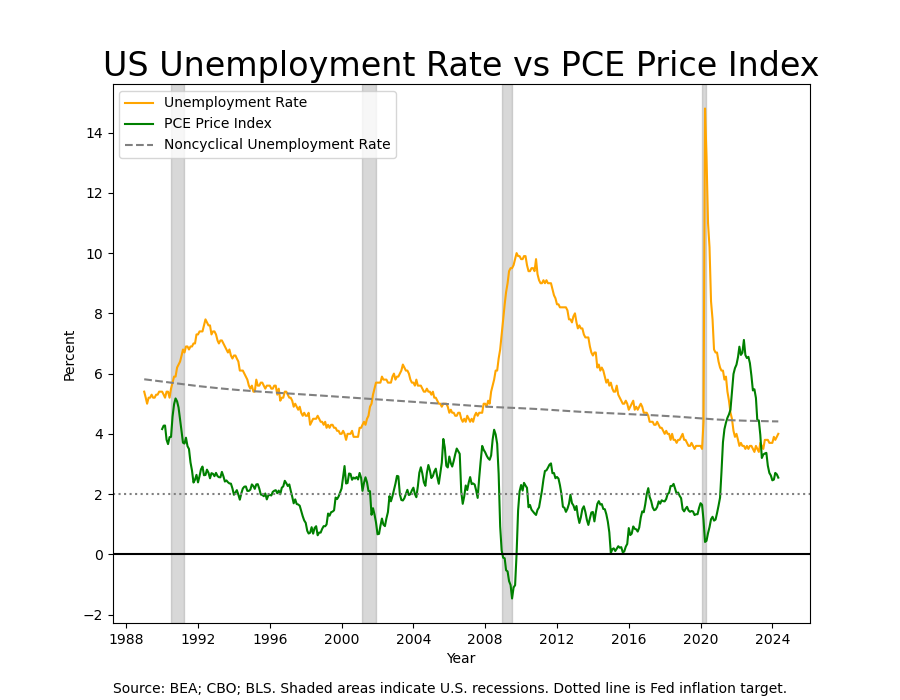

In the first quarter, the Fed was dissatisfied with the progress it had made against inflation. It took a more hawkish tone in its communications, and increased interest rates without actually setting a higher policy rate. In the second half of 2025, we’ll see if these higher rates will be sufficient to quell still-nagging inflation. Looking at Personal Consumption Expenditures and the Unemployment Rate, things sure seem to be heading in that direction.

Share this post