ἀνερρίφθω κύβος -Menander, as quoted by G. Julius Caesar

You’ve often seen them but perhaps aren’t as familiar with their name: fasces. An axe bound within a bundle of rods, the fasces were adopted by the Romans from their Italian progenitors, the Etruscans, as a symbol of power; they contained the implements necessary for the state’s legitimate administration of physical violence against the governed. The fasces were borne by lictors, a bodyguard who accompanied first the Roman kings and then Roman magistrates wherever they went.

The political economist Max Weber wrote in Politics as Vocation1 that the State is the sole grantor of the right to the use of physical force. A state is a state because it has a monopoly on the use of force over a given people. In the case of jailing or killing highway robbers to protect the property rights of the body politic, this is desirable; in the case of prohibiting the expression of dissent or prevention of free association to preserve a king’s personal privilege, it is not.

As we mentioned last week, the Tarquin kings of Rome wielded their monopoly on power so unjustly that the people of Rome forever banished kings and vested ultimate executive power in two annually elected magistrates, called consuls, each of which were allotted twelve lictors. Only the consuls or their delegated magistrates could exercise imperium—literally, the power to command (imperare, from which we derive emperor) force—within the Roman state. And the consuls’ exercise of power was further constrained by the laws of the Senate and Assembly so that the state wouldn’t ever again be beholden to the whim of a capricious monarch.

The Greeks and Romans recognized this problem of identification of the state with a single individual, and so Rome and Athens divorced political power from the person of a king or tyrant. It was only in national emergencies that a single person was granted sole executive power, such as invasion or civil unrest. In Rome, for example, this happened at least twice2 during the life of L. Quinctius Cincinnatus3, who was declared dictator—one whose words (dicta) have the force of law—first to defeat the Aequi, and then to suppress an uprising of the Plebs. The dictator was accompanied by the full retinue of 24 lictors, but the appointment was understood to be only temporary and to pertain solely to the specified emergency. Thereafter, as Cincinnatus did twice, the dictator would renounce his power and executive authority would revert to the consuls.

In 82 BCE, L. Cornelius Sulla, recently triumphant in his conflict with Marius and Cinna after him, had himself named dictator to restore the orderly administration of law and justice at Rome. Once he adjudged the Republic to be stabilized, he surrendered the role of dictator and was elected one of two consuls for the year. His assumption of the role of dictator after so many years of disuse set the precedent for C. Julius Caesar’s assumption of the office almost forty years later.

After having been ordered to relinquish the governorship of Gaul—and with it, command of the armies he had led to the subjugation of Gaul and Britain—and return home likely to face political persecution at the hands of his rival Gnaeus Pompey’s allies in the Senate, he instead refused and in 50 BCE led his loyal veterans across the Rubicon River in northeastern Italy. The importance of this act is that Julius Caesar’s legitimate imperium only pertained to the provinces of which he was governor; by commanding force beyond the borders of Cisalpine Gaul, he had wrested from the Senate and People of Rome their legitimate right to the exercise of force in Rome proper. In so doing, he is supposed to have uttered the words of the Greek playwright Menander, saying ‘Let the die be cast,’ which we might today interpret to mean, ‘Let the chips fall where they may.’

Caesar prevailed in his Civil War and afterward set himself to reforming and restoring Rome, which included granting clemency to a number of those who had sided against him4. However, he had failed to learn an important lesson from Sulla’s surrendering of the same office two generations prior, that once ultimate power has been obtained, it is not so easily dispensed.

Shortly after being named dictator perpetuo (in perpetuity) in 44 BCE, a conspiracy of Senators assassinated Julius Caesar in the Theater of Pompey.

Prices

The annualized, not-fatally-flawed Consumer Price Index three-month moving average and monthly change both show deceleration and inflation below target. No sign of price pressures in these data.

Core consumer prices in the US, which exclude food and energy, rose by 0.1% over a month in May of 2025, following a 0.2% increase in April and below the expected 0.3% advance. Medical care (+0.3%), motor vehicle insurance (+0.7%), household furnishings and operations (+0.3%), personal care +0.5%), and education (+0.3%) all rose in May, while airline fares (-2.7%), used cars and trucks (-0.5%), new vehicles (-0.3%), and apparel (-0.4%) saw declines. Year-over-year, core CPI rose by 2.8%, holding at 2021-lows, consistent with the previous two months and slightly under market expectations of 2.9%.

When using a combination of survey and market-derived sources, inflation expectations remain above the Fed’s target for the next five years.

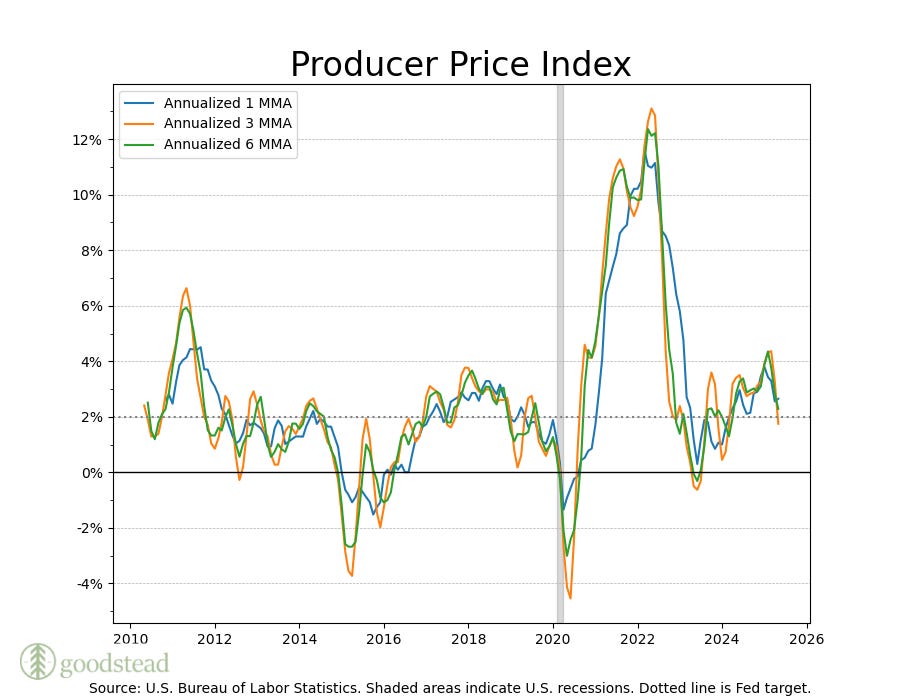

Producer Price Inflation, a measure of inflation in the pipeline, shows price change is just above Fed target on the most recent measures. May’s figure is turning up, which we take as a sign of things to come. The Fed beat inflation, but now the Administration looks to beat the Fed.

Meanwhile, Wholesalers’ Final Markups recovered to average. This suggests that Wholesalers may have more pricing power and won’t have to absorb losses.

Labor

Initial claims were static at 248,000 in the first week of June and above market expectations of a decline to 240,000. This is the highest level since early October 2024, perhaps a signal that the labor market is loosening further. The four-week moving average rose to its highest level since late August 2023. Rising, but still not high enough to suggest that the economy is in decline.

Meanwhile, Continuing Claims for Unemployment Insurance jumped by 54,000 to 1,956,000 in the week ending May 31, the highest since mid-November 2021 and well above forecasts of 1,910,000. Continuing claims have risen on a three-month moving average basis and stand at the highest level since October 2024 on a monthly basis. Finding work is getting harder, an early sign of economic contraction.

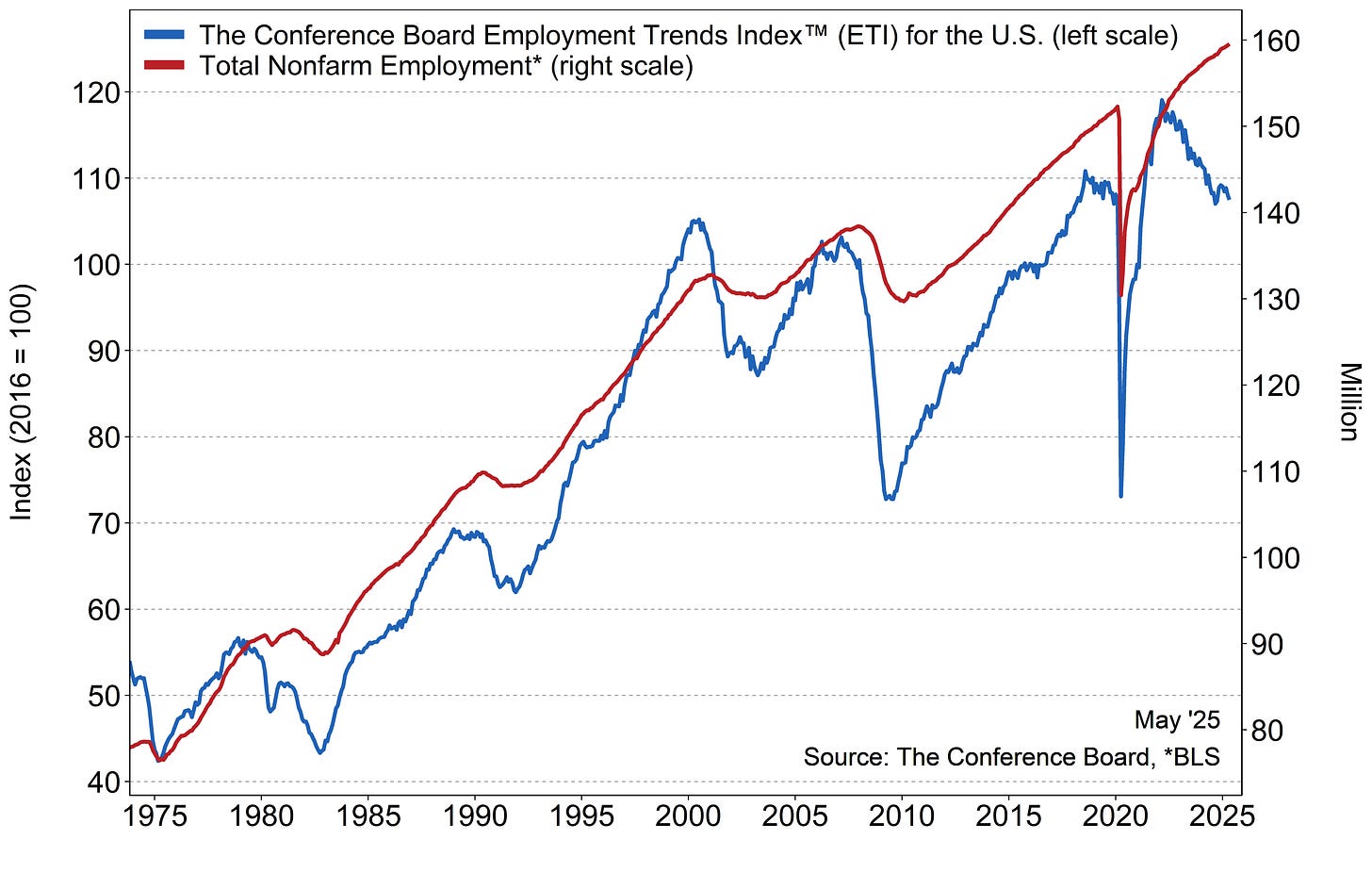

The Conference Board aggregates Labor Market indicators and presents them in its Employment Trends Index. “May’s decrease in the Employment Trends Index was driven by negative contributions from 4 of its eight components: Percentage of Respondents Who Say They Find ‘Jobs Hard to Get,’ Number of Employees Hired by the Temporary-Help Industry, Initial Claims for Unemployment Insurance and Job Openings.”

These tend to lead layoffs, which are rising slightly.

Quits and Layoffs should be negatively correlated. Quits are down slightly, but layoffs have been stubborn to rise on a three-month moving average basis and moving sideways.

Surveys

The University of Michigan consumer sentiment index recovered to 60.5 after two months at 52.2, some of its lowest readings in its history. The improvement seems to have resulted from the slight relaxation in inflation fears and consumer pessimism, though it is hard to stay given the high degree of uncertainty in the current environment.

Manufacturing

The New York Fed’s Empire State Manufacturing Survey fell again in May, showing that Manufacturers in the New York area still aren’t expecting a renaissance in manufacturing.

Capacity Utilization and Industrial Production have both followed PPI into contraction.

Retail and Consumption

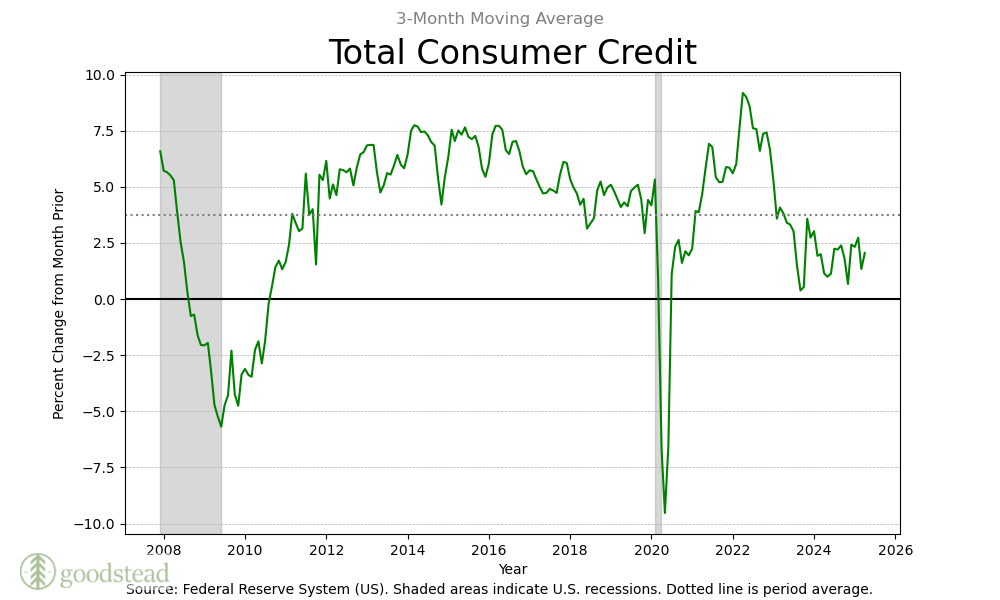

Consumer Credit took a leg higher in May as credit card usage increased at an annual pace of 7%. Nonrevolving credit also grew, but at a little less than half the pace. The lower tier consumer is likely using credit to fund consumption rather than income.

Retail Sales took a leg down in May, falling nearly 1%. This follows a downward revision to a 0.1% drop in April. It is the biggest decrease in four months. Sales at motor vehicle & parts dealers recorded the largest decline (-3.5%), followed by building material & garden equipment suppliers (-2.7%) and gasoline stations (-2%).

Retail sales excluding autos fell by 0.3% month-over-month in May 2025, following a revised flat reading in April, and worse than market forecasts of a 0.1% rise.

Business Inventories saw no change month-over-month in April, after a miniscule 0.1% increase March. Stocks held by retailers were unchanged after falling 0.3% in March, while those held by manufacturers declined 0.1%, following a similar rise a month earlier. Inventories at merchant wholesalers rose by 0.2%, after a 0.3% increase. On an annual basis, business inventories rose by 2.2%.

There is evidence of destocking here.

International Trade

Import Prices rose 0.2% from the previous year in May of 2025, relatively close to the 0.1% increase from the previous month, which was the softest increase in eight months.

Export prices rose 1.7% in May 2025, the least in six months, easing from a downwardly revised 1.9% advance in April. Prices in the BLS index exclude tariffs but may still reflect their impact through market behavior changes.

This is unexpected given dollar weakness, but a recession in international trade would be growth negative, consistent with disinflation or deflation.

In Sum

The contraction in growth is beginning to gather pace. Still, the equity and bond markets continue to trade as though the expansion will go on forever. The US 10 Year auction on June 11 cleared at a yield of 4.421%, an increase from the prior auction at 4.342%. Yields are going the wrong way if growth is slowing unless investors are pricing in a probability of higher future inflation.

The 30 Year auction, an issue that is mostly targeted at insurance companies and other long duration investors, cleared at 4.844%.

Over the past three months, the short end of the yield curve has fallen, reflective of higher demand for the risk-free security. What had been higher demand for longer-dated treasuries has been supplanted by either diminished demand for longer dated treasuries or else a higher term premium, additional compensation demanded for the risk of holding an irresponsible country’s debt.

The Fed meets this week and releases a new set of projections for growth and inflation. Based on slowing growth, and the uncertain impacts of tariff policy on slowing inflation, the Fed is expected to leave rates where they are. The markets continue to expect about a half a point of cuts over the coming year.

Thus far, slowing growth has been more pronounced than rising inflation. That could change if energy prices go higher and take inflation with it as a result of conflict in the middle east. But global supply is already high and other factors should keep it that way. An energy shock is therefore unlikely; however, the impacts of tariff policy have yet to fully be felt in the United States, and this is why inflation has been tame over the first half of the year. The Fed stays here and in our view likely remains unless series risks to the full employment mandate materialize. If the Fed was too focused on the Employment mandate before at the expense of higher inflation, now they will focus on the Price Stability mandate at the expense of higher unemployment.

Politik als Beruf, 1919

In 458 and and 439 BCE.

Because George Washington renounced his power after successfully prosecuting the War of Independence, he was likened to Cincinnatus, and by reason of this association the Ohio city was named after him.

More accurately, took the side of the Republic, rather than the side of Pompey.