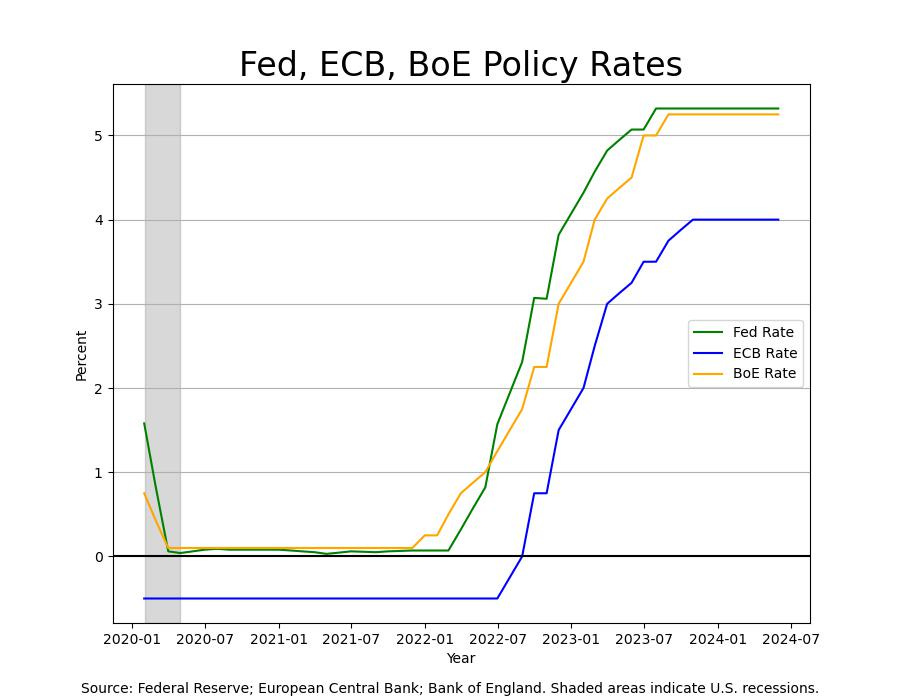

The lead economist for the European Central Bank (ECB), Philip Lane, let us know in an interview with the Financial Times that the Eurozone group of economies has made enough progress against inflation to warrant cutting interest rates, barring any major surprises, at its next meeting June 6. The short-term interest rate currently stands at 4% for the 20 member states that use the Euro, where it has been since September of 2023.

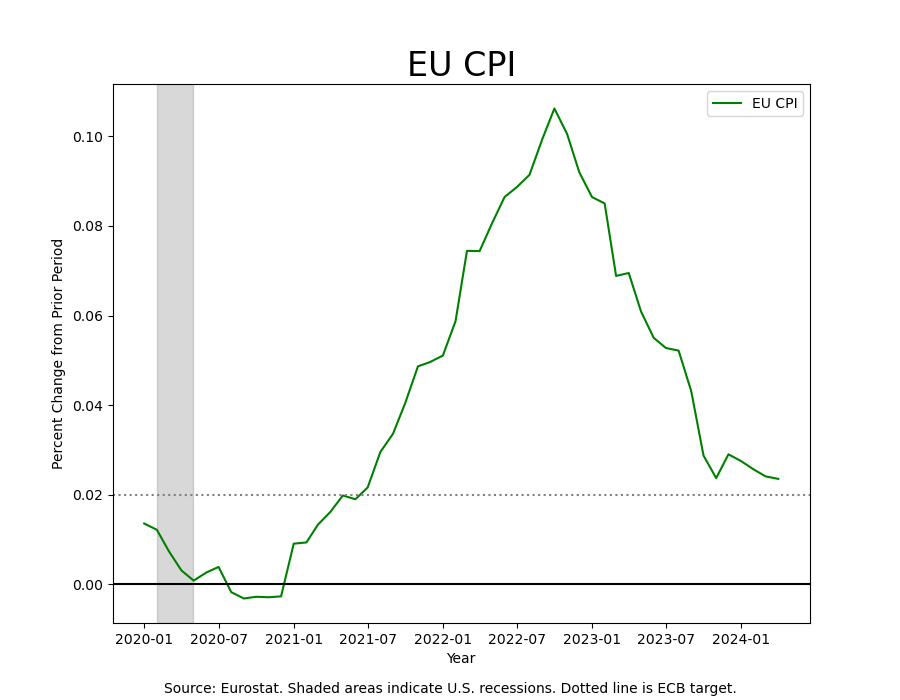

Inflation for the Eurozone has fallen considerably from its 10.6% peak in October of 2022 to 2.4%.

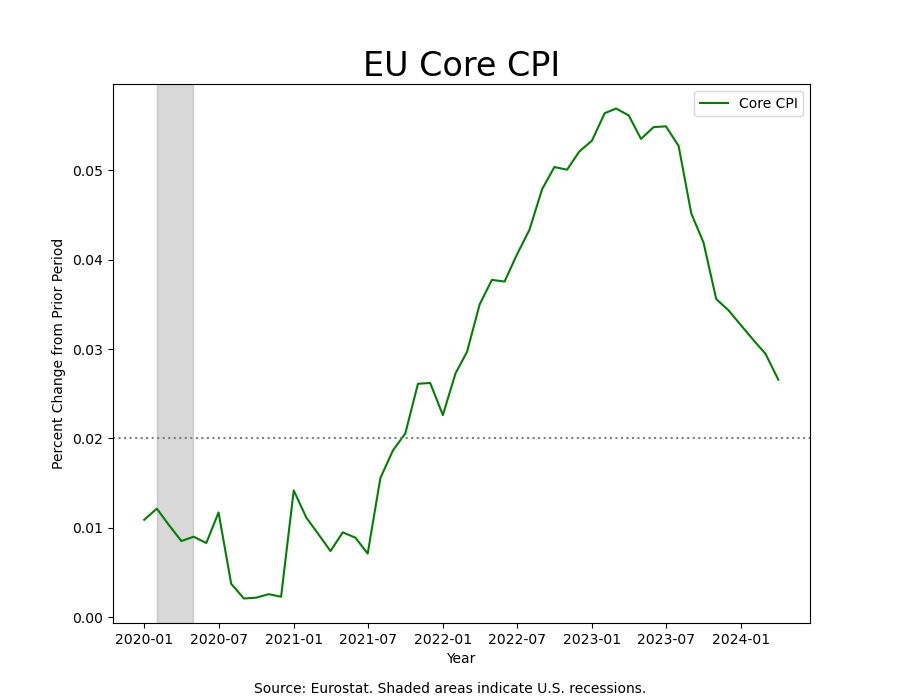

It’s fallen on a core basis (excluding food and energy) as well, from 5.7% to 2.7%.

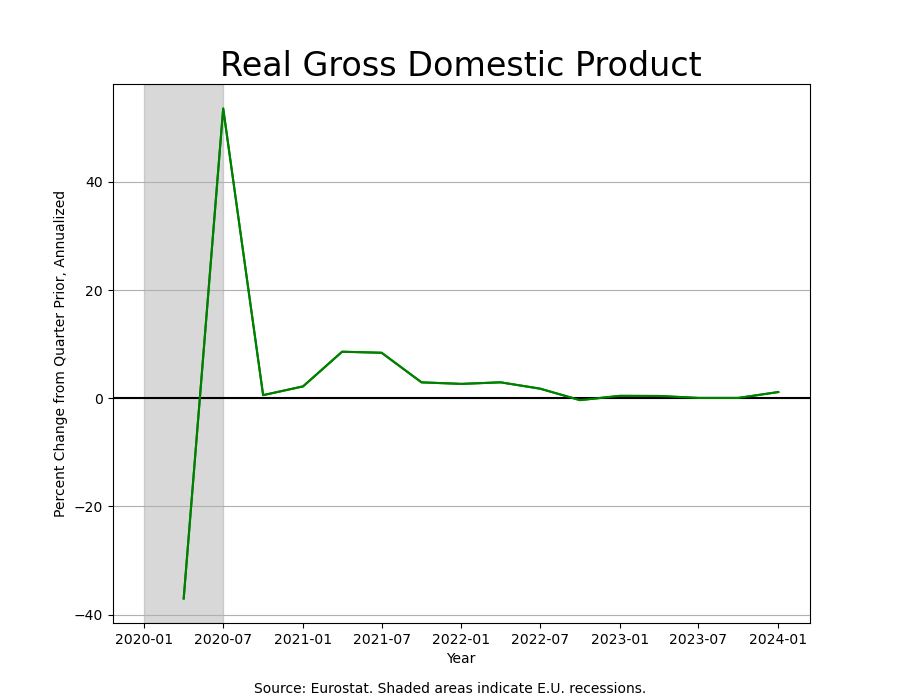

After adjusting for inflation, real interest rates in the Eurozone area of 1.6% and rising are unquestionably too high for an economy that only managed to register 1.3% of real growth in the first quarter of 2024.

An economy as large and advanced as Europe’s should be able to grow at a much faster rate, about 1.75%. (The ECB has itself forecasted growth of between .8% and 1.5% for this year and next year, respectively.) Europe’s economy is far less dynamic than that of the United States, so it is unlikely that it will shock observers with rapid rates of growth in the coming years in the way the US has. But exports have increased, consumer and business sentiment have improved, and manufacturing has expanded, all of which signal that the Eurozone is threatening a return to sustained growth.

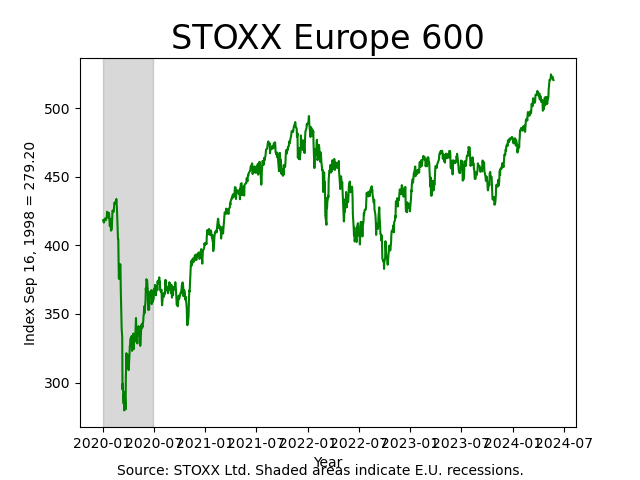

Optimism about increasing growth rates in Eurozone might now be reflected in the increase in the value of European large cap stocks as represented by the Stoxx Europe 600, which has seen an increase of 9.2% year-to-date, with 3.7% of that gain coming since the start of May.

European stock indices are heavily weighted toward financial firms, so lower interest rates have an outsized impact on the growth rate of these firms’ cash flows. Likewise, luxury goods makers as well as automakers have rallied on rate-cut expectations. Even compared to the S&P 500’s increase over the same period of 11.8%, this is quite a significant change. We’ve written before that we and others continue to find value in Europe where earnings yields are currently 6.7% (versus 3.8% for the S&P 500), and so actually compensate the investor for taking equity risk (a forward-looking equity risk premium of about 4%).

The Eurozone appears to be transitioning from the Contraction phase of the business cycle to Recovery, in which short rates fall, equities rally, inflation falls or is quiescent, and bond yields are flat. The United States, however, still looks to be in transition from Expansion to Slowdown, so the Eurozone and the ECB find themselves in the unusual position of being the first major economy to relax interest rates. The United States may not be far behind, but for the meantime, Europe for the first time must become accustomed to leading the way.