δυνατὰ δὲ οἱ προύχοντες πράσσουσι καὶ οἱ ἀσθενεῖς ξυγχωροῦσιν

In his History of the Peloponnesian War, the statesman-general-historian Thucydides imagines a dialogue between the Athenian and Melian ambassadors at a pivotal time in the struggle for supremacy of the Hellenic world between Athens and Sparta. In 416 BCE, Melos, an island in the southwestern Aegean, has just been invaded by the Athenians, who have thereupon demanded its Spartan colonists surrender and pay tribute to the Delian League, effectively the Athenian Empire. The Melians argue that they have been neutral in the war, that the Athenian demands are unjust, and that the gods and other Greeks will punish the haughty Athenians for their naked exercise of raw power. The Athenians dismiss these arguments saying that the gods favor the strong, and that in the real world, “the strong will do what they can, and the weak will suffer what they must.” Upon the Melian refusal of these terms, the Athenians lay siege to the city and starve the populace until they give out that winter. Once they acquiesce, the Athenians execute all remaining men and enslave the women and children. Thereafter, we first find usage of the term ‘Melian Famine’ in Attic drama which comes to mean a particularly brutal privation.

The passage in Thucydides is interesting because much of the story the Athenians tell us about themselves has to do with their belief in rights and liberties. Perhaps we are to believe that these rights and liberties only rightly belonged to Athenians, and so didn’t extend to their fellow Hellenes. After all, the Athenians employed a system of bonded servitude both for autochthonous Athenians as well as captives of war; likewise, the Spartans who fought the slave army of Xerxes at Thermopylae for the freedom of all of Achaea famously lorded it over their own enchorial serfs, the Helots, back in their home country of Laconia. These are inconvenient details in the tradition of freedom and democracy that we inherit from the Greeks.

But perhaps Thucydides narrates the episode not out of the duty of the historian, but as an explanation for the Athenians’ loss of their hegemony; they no longer deserved to lead the free Greek city states, since power had corrupted them so thoroughly as to be little better than their competitors for world mastery, the Persians. Read this way, it is the Athenian betrayal of exactly those values which historically set them apart from their co-imperialists that is responsible—far more than the Spartan navy—for their downfall.

Surveys

The Federal Reserve Bank of Chicago National Activity Index for the US fell to -0.03 in March 2025 from +0.24 in February, further adumbrating the emerging picture of economic contraction. Production-related indicators were down in March after having been up in February. Leading sales, orders, and inventories categories as well as employment-related indicators were also in negative territory. Personal consumption and housing were strongly positive, likely on tariff front running. The three-month moving average turned negative, confirming the growth contraction trend.

This contraction comes despite the same bank’s estimation that financial conditions remain loose. It is not because of lack of access to capital that the economy is deteriorating. Financial conditions have been tightening but are not yet tight. This argues for a lull in aggregate demand.

Because of the federated nature of the Federal Reserve system, bank surveys can feature a regional flavor. Similarly, economic strength in one district can be coincident with economic weakness in another. We’ve seen the Philadelphia and New York Federal Reserve Banks’ surveys of manufacturing activity come in negatively over the past week, but now we see much the same picture in both the Federal Reserve Bank of Dallas’ survey on general business conditions, down on a monthly and three-month moving average basis

which weakness is mirrored by the Federal Reserve Bank of Richmond’s survey, too. Declining manufacturing activity and business conditions are not a blue state phenomenon.

Retail and Consumption

In a sign of consumer distress, the largest US banks’ credit card account holders are making only the minimum payment on their outstanding balances. Better household balance sheets were a consequence of the COVID-19 pandemic, which time of enforced personal austerity allowed consumers to pay down debt. That those on the lowest rung of the income ladder may be drawing on credit to fund expenditure appears more likely now.

Retail Inventories excluding motor vehicles have hung around their average over the last quarter. As the volume of shipments and truck freight are falling and expected to fall further, we should expect Retail Inventories to follow. When the full effects of the cessation in trade with China are felt in May and June, we should see these levels collapse in June and July. Stay tuned.

Housing and Construction

The 30 Year Fixed Rate mortgage is holding at 6.9%, up about ten basis points over the past week. Although this rate is still below that of the longer-term average mortgage rate in the United States, the level of house prices makes the debt service on a mortgage loan unaffordable for most Americans.

Until prices fall or stock increases, home purchases will continue to move sideways. While sales of new single-family homes in the United States rose by 7.4%, the highest in six months, most of those home were not purchased by newly formed households. Median prices were lower by 1.9% at $403,600, and there’s still 8.3 months of supply in the market.

Manufacturing

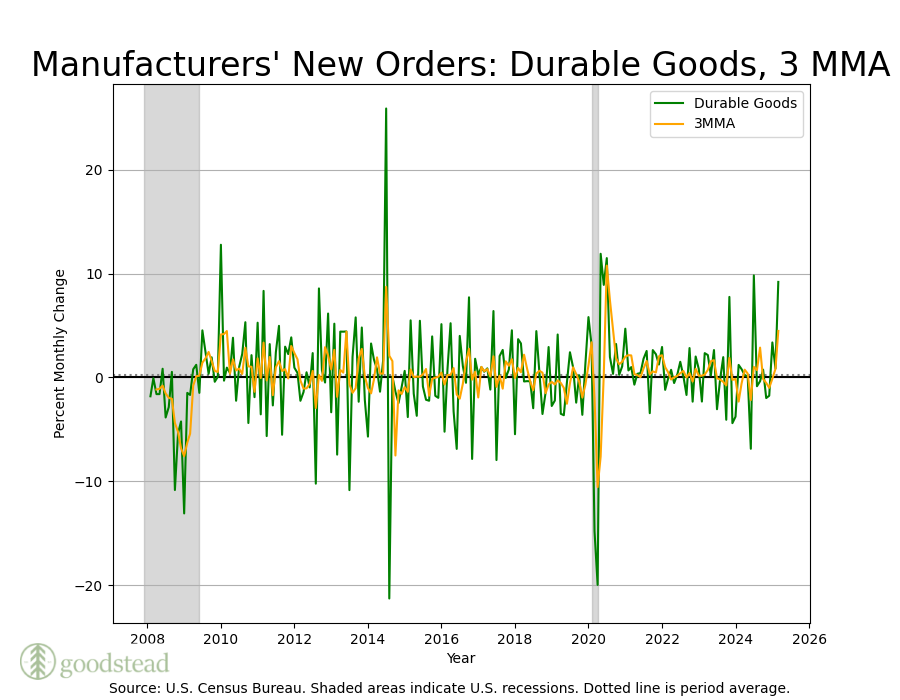

New orders for durable goods in the US spiked 9.2% month-over-month in March, marking the third consecutive monthly increase and far exceeding market expectations of a 2% increase. New Orders for Durable Goods were 7% higher than expected in March, but peering into their composition reveals causes for concern. Transportation was responsible for 27%, mostly aircraft and motor vehicle parts, i.e., tariff targets. Less these increases, new orders were flat. Non-defense capital goods excluding aircraft, which is sensitive to business fixed investment, barely increased and was lower than expectations.

Durable goods inventories are running below average, though ticked slightly up in the quarter.

The change in unfilled orders was dramatic, even on a three-month moving average basis.

Shipments overall were down.

In Sum

This week is a rich one for macroeconomic data. A bevy of GDP, price, labor, and other hard data come in between today and Friday, so we will be busy toward the end of the week helping you make sense of it. In the meantime, our calls remain generally the same: US equity and fixed income weakness; Europe, APAC and EM equity and fixed income strength (comparatively); volatility and real assets should continue to outperform while the air continues to leak out of the AI bubble. Next month we’ll begin concluding our missives with a report on the performance of the assets that make up the global market portfolio, as well as our views on each given fundamental, technical and political-economic factors.